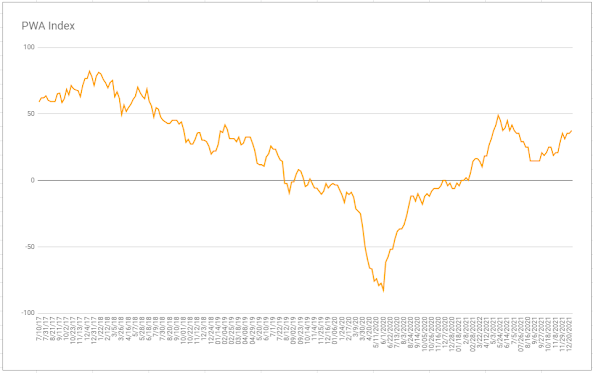

Our own general conditions index rose 2 points last week, thanks to our score for consumer confidence going from negative to neutral, along with a pick up in truck tonnage. The only negative mover among our 48 inputs was the sectors/SP500 ratio; back to negative, after just a week in the plus column:

Consumer Confidence:

Truck Tonnage:

Financials/SP500 Ratio:

Consumer Discretionary/SP500 Ratio:

Energy/SP500 Ratio:

Industrials/SP500 Ratio:

Defensive Sectors (Staples, Utilities, Healthcare)/SP500 Ratios; each outperforming (above the white line) the broader index over the past 30 days:

Of the 13 (of the 16) Asian markets we track that were open overnight, 7 closed higher.

Of the 17 (of the 19) European bourses we follow that are open this morning, 13 are in the green, as I type.

US major averages are higher as well: Dow up 160 points (0.44%), SP500 up 0.85%, SP500 Equal Weight up 0.47%, Nasdaq 100 up 1.26%, Nasdaq Comp up 1.03%, Russell 200 up 0.26%.

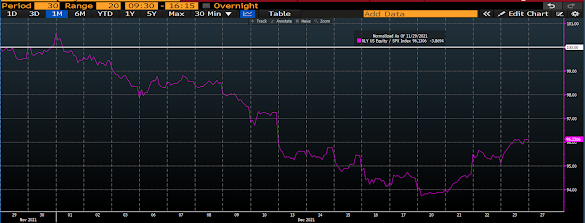

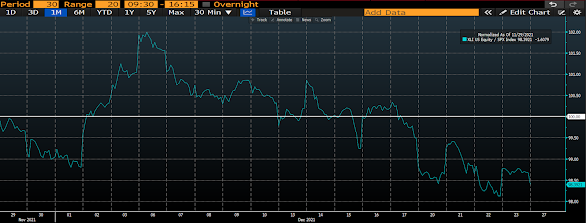

The VIX sits at 18.54, interestingly (given this morning’s rally) up 3%. VXN (Nasdaq implied volatility measure) is up 5% so far this morning. The latter in particular is at odds with this morning’s strong move in tech stocks. While their respective levels aren’t alarmingly high, this morning’s moves (which aren’t alarmingly extreme or entirely unusual, just interesting) essentially say that some downside bets are being placed in the options market.

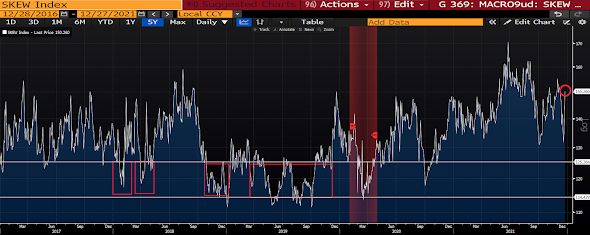

Portfolio hedging activity (along the lines of what we perform) can be captured by the SKEW index (it’s like the VIX but measures the volatility in out-of-the-money SP500 options):

A 150 says investors are buying protection…

Oil futures are up 1.56%, gold’s up 0.20%, silver’s up 0.76%, copper futures are up 0.80% and the ag complex is up 0.03%.

The 10-year treasury is up (yield down [another potentially defensive signal amid an equity market rally]) and the dollar is up 0.13%.

Led by MP (rare earth miner), AMD (chip maker), Nokia, SOXX (chip maker index ETF) and uranium miners — but dragged by solar stocks, Viacom, base metals futures, Disney and Verizon — our core portfolio is up 0.41% to start the day.

Our friend and colleague Hari Krishnan, in his excellent book The Second Leg Down, echoes our latest messaging around measuring risk and acknowledging it in our overall strategy, as opposed to predicting if/when an event will occur:

emphasis mine…

“…it is best to assume that predicting financial crises is like predicting earthquakes. We can identify situations (geological fault lines) which are unstable, but can’t with any certainty say when an event will occur.”

Have a great day!

Marty