The strategists who are bullish on stocks heading into next year make the legitimate case that $2+ trillion in consumer savings accounts makes for not-small support for corporate earnings growth — as those flush-feeling consumers consume well into 2022.

“…companies will be spending at least 2022 and likely 2023 trying to recapture the lost margins due to their spike in costs. They will essentially piece meal out price increases in some form.

Walmart for example is not going to accept a sharp increase in price from General Mills in one shot. General Mills said this in their release, “Already this fiscal year we have announced multiple rounds of pricing across our portfolio, utilizing all four SRM (Strategic Revenue Management) levers: list pricing, promotion optimization, pack price architecture, and mix management. We’re seeing the impact of these actions flowing through in the market, with our average unit prices rising steadily over the course of the year.””

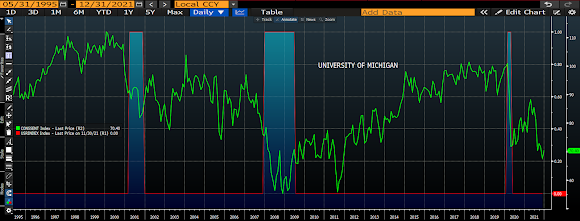

And, yep, per the latest read — The Conference Board’s survey released yesterday — consumer sentiment looks to be picking up:

Words to live invest, by famed investor Howard Marks:

“The superior investor is attentive to cycles. He takes note of whether past patterns seem to be repeating, gains a sense for where we stand in the various cycles that matter, and knows those things have implications for his actions. This allows him to make helpful judgments about cycles and where we stand in them. Specifically:

- Are we close to the beginning of an upswing, or in the late stages?

- If a particular cycle has been rising for a while, has it gone so far that we’re now in dangerous territory?

- Does investors’ behavior suggest they’re being driven by greed or by fear?

- Do they seem appropriately risk-averse or foolishly risk-tolerant?

- Is the market overheated (and overpriced), or is it frigid (and thus cheap) because of what’s been going on cyclically?

- Taken together, does our current position in the cycle imply that we should emphasize defensiveness or aggressiveness?”

–Marks, Howard. Mastering the Market Cycle: Getting the Odds on Your Side

Have a great day!

Marty