In this part six of our year-end letter I’ll present an overview of how we see the U.S. equity market setup on a sector by sector basis.

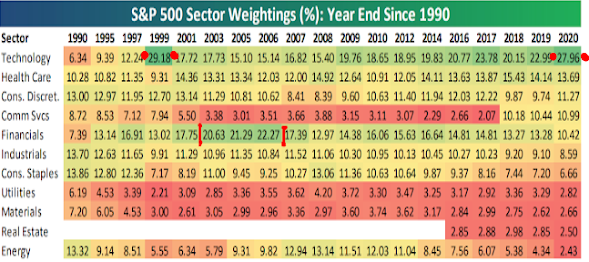

First, let’s take a look at how the major sectors stack up in terms of their weightings within the S&P 500 Index (compliments of Bespoke Investment Group).

I.e., our hedging portfolios these days has zero to do with bent or bias… It’s all about data, human nature, and history…

Communication Services

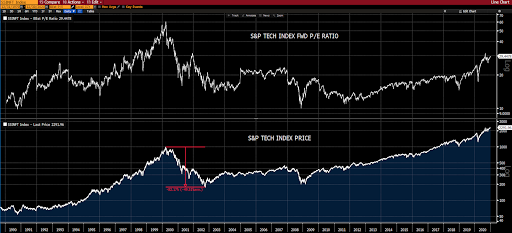

Considering the most heavily weighted companies in the index — Facebook, Google, Netflix, Disney and two positions we hold individually AT&T and Verizon — one could argue Nick’s tech-is-now-a-staple point with regard to the communications sector as well. And I totally agree, these companies are 100% essential and are here to stay.

That said, they’re presently rich in price relative to their prospective earnings, and 2021 is going to be a year of intense antitrust scrutiny toward the likes of Facebook and Google from, in particular, the U.S. and Europe. Whether or not that’ll, by itself, spell bad things for these stocks remains to be seen…

“China is on yet another tear when it comes to infrastructure spending within their own economy; gobbling up much of the world’s industrial commodities production in the process. Plus, with their “One Belt, One Road” initiative, they are rapidly expanding across the globe, financing infrastructure projects from East China through Southeast and South and Central Asia all the way to Europe.

And while there’s much to parse in this massive global outreach — including the potential to provide a huge springboard for China’s own digital currency, which some view as the most credible threat to the U.S. dollar’s global dominance going forward (a serious topic we’ll no doubt broach often and in detail in the months to come) — make no mistake, with regard to commodities demand, it’s big!”

“Driven by latest blockchain technology, China’s digital currency does not require a bank account. This has huge poverty-relief potential for the unbanked poor across the globe.”

Materials

While materials are also not cheap on a price to forward earnings basis, we like them a lot nevertheless.

In a nutshell, as I noted in Part Five, the world’s in building mode, so of course we want to own materials (we hold the base metals commodities ETF), and the companies that produce them (the materials stock ETF).

We came into the year with materials stocks at 8% of our U.S equities target, we’re now at 15.5%.

And, while, again, we like them a lot going forward, they could be cheaper:

Real Estate (REITs)

Real Estate Investment Trusts (REITs) come in different shapes (multi-family housing, senior living, healthcare, shopping malls, offices, storage, mortgage, etc.). In lieu of what we viewed as safer/more attractive sectors we took them down from 10% to start the year to zero presently.

XLRE, the S&P REIT-tracking ETF still remains nearly 14% below its pre-Covid peak.

While we’ll definitely keep an open mind, and will no doubt own the space again in the future, at present we’re not eyeballing more than maybe a small allocation…

Valuation-wise, we’re uninspired:

11/9: Within U.S. equities, we’re about to cut utilities by 30% and add to energy stocks with the proceeds… Within our non-US exposure, we’re cutting Europe by 22% and adding to emerging mkts with the proceeds…

The energy exposure gives us more tilt toward commodities (and, btw, materials is now our largest U.S. sector target), plus it’s off ~50% from its peak, and has seen tremendous capacity destruction the past few years…

I suspect people will think a Biden win is negative for fossil fuels, but they’re missing the fact that Trump was opening up public land for drilling.. Of course Biden will squash that in a hurry…

Again, lack of capacity, with any amount of demand coming back likely bodes well for the sector (via, for example, the price of oil) in the months/years to come…

11/24: Adding a bit more energy exposure (cutting some utilities exposure) by introducing OIH to the core mix. OIH is an energy ETF that focuses specifically on oil and gas service companies, as opposed to the producers themselves.

This is a nice complement to XLE, as it’s concentrated in 25 names that will be instrumental as companies scramble to bring capacity back on line as folks, and businesses, become more mobile post-covid (with the attendant rise in oil and gas prices). A substantial infrastructure bill, if, as expected, is passed in 2021, will of course add upward pressure to the space as well.

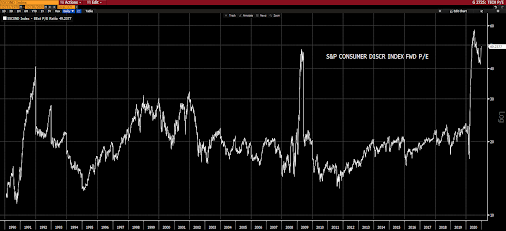

Now, don’t get too freaked out by this forward p/e chart. Apparently there’s been zero guidance offered since mid-year:

Perhaps we should look at this one on a price-to-book-value basis:

That’s better!