I’ve mentioned several times herein of late that, presently, the bull market in equities is more about stimulus than it is fundamentals. A relationship/correlation that makes for a precarious overall setup, from a couple of perspectives:

1. As the macro data improve — either due to positive cyclical or “stimulative” factors, or both — savvy market participants understand that the need for further stimulus begins to abate, and, thus, being sensitive to what has equities at all time highs, they take defensive measures.

2 (really just expanding on #1). When things are bleak, and sentiment is therefore low, central banks inject liquidity into the economy. As those liquidity injections in total exceed overall economic need (resulting in excess liquidity), they tend to find their way into assets — boosting their prices, and overall investor (and consumer) confidence, in the process. As confidence increases, the need to inject more liquidity abates — and the corresponding decline in excess liquidity presents a not-small headwind for asset prices.

While the above, in and of itself, does not a bear market make, any hint (which is all we should realistically expect given the Fed’s fear of cracking markets) of taking away, or even the slightest draining of, the punchbowl can spark some serious volatility — particularly when sentiment runs excessively high (i.e., when the bull side of the boat is crowded)!

Speaking of sentiment running high, our own fear/greed barometer just moved notably, from -20 to -50 (max greed would be -100).

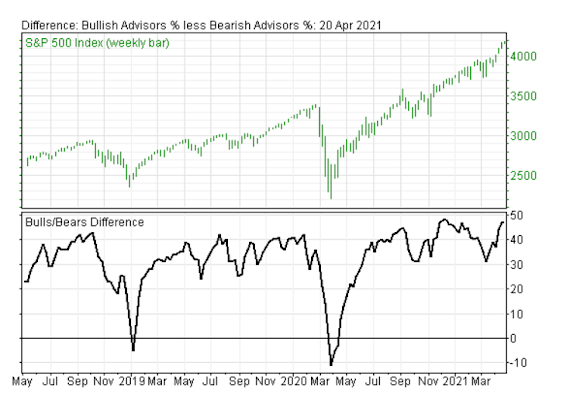

The one indicator (among the 10 in our barometer) that really has my attention is the “Advisor Bull-Bear Spread.” It (bottom panel) is historically high!

“The bull-bear spread expanded further to +47.0%, from +46.6% last week. Six weeks ago the difference was +30.4%, just missing a drop below the danger signal, so over that short period risk has increased dramatically. Now it is near the +48.0% spread shown late Nov-20. Above +30% counts show more risk the higher they get, with defensive measures signaled above 40%. The spread was +41.5% in Jan-20, and +43.2% in late Sep-18, both times before major market declines.”

Like I said in this morning’s note, “beware the uber-confident expert!”

Lastly, in terms of the near-term stock market setup, and speaking of liquidity, we’re about to enter a period of historically-low flow (May thru ~October) into equity mutual funds. Hence the old market-timer adage, “sell in May and go away.”

Bottom line: While being relatively constructive on stocks still makes some sense right here, we anticipate a very choppy market over the next few weeks/months.

What we really like:

It’s no secret with clients and blog subscribers that we’re liking commodities these days — although we anticipate choppy action near-term there as well — and if we like commodities, we of course like the companies that pull them out of the ground.

Crescat Capital does a lot of deep work in that space and, like us, they’re presently bullish on the miners.

Here’s their chief strategist on free cash flow across gold and silver miners:

“In a nutshell, Annie Duke captures what I view to be probably the greatest, albeit hidden, danger that more than any other explains how too many folks ultimately fail at the game (the art) of investing.

It’s the too-often destructive (eventually) — at times devastating — belief that short-term positive results always stem from quality decision-making:

“…as I found out from my own experiences in poker, resulting is a routine thinking pattern that bedevils all of us. Drawing an overly tight relationship between results and decision quality affects our decisions every day, potentially with far-reaching, catastrophic consequences.””

“…replacing “Was it a good decision?” with “Did it have a good outcome?”—is both popular and pernicious. Savvy poker players see this mistake as a beginner’s blunder.

A novice may overestimate the probability that the next card will win her the hand, bet big, get lucky, and win, but winning doesn’t retroactively make her foolish bet wise.

Conversely, a pro may correctly see that there is a high probability of winning the hand, bet big, get unlucky, and lose, but that doesn’t mean her bet was unwise.

Good poker players, investors, and executives all understand this. If they don’t, they can’t remain good at what they do—because they will draw false lessons from experience, making their judgment worse over time.”