You could argue that Asian equities’ (Japan in particular) weakness overnight had something to do with Japan moving back into a state of (covid) emergency — it wasn’t announced until this morning, but it was rumored during the session. You could also surmise that, after a nice run of late, markets are simply taking a breather.

Europe’s taking a beating this morning on no apparent news, although Russia has amassed a hundred thousand troops along the Ukrainian border…hmm…

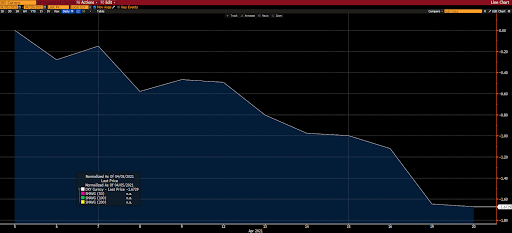

In my April 2nd video commentary I pointed to what I viewed as a notably bearish technical setup for the dollar.

Here’s the action since:

I also mentioned that that essentially equates to a bullish setup for our commodities exposures.

Here’s the action in our positions with direct (the commodities and futures themselves) exposure since:

Now, the above is not — not in the least — me saying “I told you so”; trust me, having been humbled by markets for the past 36 years, that (save for perhaps the occasional look back to a prior comment — but only to reemphasize a point) will never happen! What it is, on the other hand, is us simply doing our job — i.e., constantly checking intermarket relationships to ensure that the whys of our overall thesis are still intact. And we’re presently longer-term bearish on the dollar, bullish on commodities…

You see, different asset classes trade on different factors at different times. Stocks, for example, are presently trading more on the prospects for further stimulus than they are on the underlying fundamentals. Gold at times trades largely on movement in the dollar, at others on the level of real interest rates. Ag commodities can trade on the dollar, or on the weather, or on geopolitics, etc… And so on…

Asian equities (Japan and India [covid] in particular) tilted red overnight, with 9 of the 16 markets we track closing lower.

Europe’s taking a total beating this morning, with all 19 of the bourses we follow notably in the red as I type.

U.S. major averages are struggling as well: Dow down 241 points (0.71%), SP500 down 0.65%, SP500 Equal Weight down 0.79%, Nasdaq 100 down 0.65%, Nasdaq Comp down 0.89%, Russell 2000 down 2.11%.

The VIX (SP500 implied volatility) is up 10.24%. VXN (Nasdaq i.v.) is up 6.97%.

Oil futures are down 2.87%, gold’s up 0.27%, silver’s up 0.25%, copper futures are down 0.14% and the ag complex is up 1.00%.

The 10-year treasury is up (yield down) and the dollar is up 0.02%.

Led by ag commodities, gold miners, utilities stocks, consumer staples stocks and gold — but dragged notably by MP (rare earth miner), oil services stocks, ALB (lithium miner), metals miners and energy stocks — our core mix is off 0.72% early in the session.

Legendary investor Jim Rogers has been around the world block — literally — a time or two, and he’s quite the student of history:

“The main lesson of history is that people don’t learn the lessons of history.”

–Jim Rogers

Have a great day!

Marty