We’ll update you on the macro in quick and easy fashion this week.

Our proprietary index gained 2.08 points, for an overall score of +20.83:

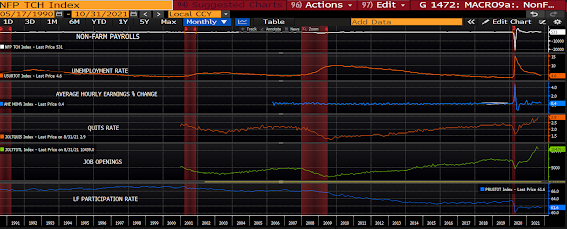

“This morning’s job numbers did not disappoint!

531k new jobs, 80k above expectations, with the two previous months revised by an additional 235k.

The unemployment rate came in at 4.6% (down .2%), while the participation rate, however, concerningly remained unchanged 61.6%.

The manufacturing space added 60k. Construction another 44k. Leisure and hospitality up 164k. Professional business services added 100k.

Wages overall rose by 4.6% annually.”

Consumer credit outstanding spiked notably; by $29.9 billion in September!

Bloomberg speaks to the positives and potential negatives of rising consumer debt:

“Growth in consumer credit can hold positive or negative implications for the economy and markets. Economic activity is stimulated when consumers borrow within their means to buy cars and other major purchases. On the other hand, if consumers pile up too much debt relative to their income levels, they may have to stop spending on new goods and services just to pay off old debts. That could put a big dent in economic growth.”

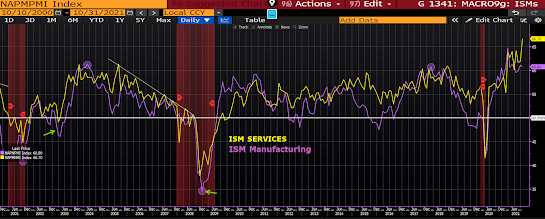

JPM’s Global Purchasing Managers (sentiment) Index continues to improve:

“In October, strong growth continued for the services sector, which has expanded for all but two of the last 141 months. However, ongoing challenges — including supply chain disruptions and shortages of labor and materials — are constraining capacity and impacting overall business conditions.””

And here’s from the Manufacturing report:

““Manufacturing performed well for the 17th straight month, with demand and consumption registering month-over-month growth, in spite of continuing unprecedented obstacles (including the Imports Index moving into contraction territory) and ever-increasing demand. Meeting demand remains a challenge, due to hiring difficulties and a clear cycle of labor turnover: As workers opt for more attractive job opportunities, panelists’ companies and their suppliers struggle to maintain employment levels.”

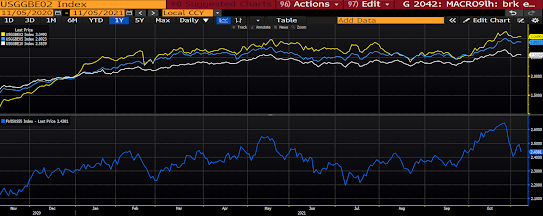

So, in a nutshell, the economy continues to improve in the face of challenges that are creating inflationary pressures that, due to their nature, will indeed abate at some point in the presumably not-too-distant future (explains the optimism in the surveys). In fact, market based expectations are (for the moment anyway) beginning to anticipate it:

Per our chart featuring treasury inflation breakevens (top panel) and the 5-yr/5-yr inflation swap rate (bottom panel):

“…the consequentiality of the Fed consequentially moving the needle would express itself immediately and dramatically in the equity market (in a not good way for the bulls). And that my friends is simply not an option for this Fed.

I.e., suffice to say that, in my humble view, this utterly stock market-centric Fed is in no way interested in the porridge (data) showing up in any way hot. They need it Goldilocks to the point that they’ll tell us (their “forward guidance” tool) that the temperature’s plenty cool, even while they’re burning their tongues…

Why? Well, have a look at our chart of U.S. household net worth:

$20 trillion of that mind-boggling $31 trillion that has arrived on household (and non-profit organizations) balance sheets since March of last year is explained by the stock market!!

Imagine the economic (consumption) impact if what some justifiably view as an epic bubble were allowed to pop. Or, let’s say, imagine the heat the Fed will bear if, as is typically the case, they — by seriously tightening policy in response to robust jobs data — catch the blame for the popping…”

Have a wonderful weekend!

Marty

PS: In case you missed it, this week’s technical analysis is worth a look:

Once playing, click the icon in the lower right corner for full screen. Focus should occur after a few seconds; if not, click the wheel to the left of the YouTube icon to adjust: