In our portfolio call this morning, Nick and I found ourselves discussing the recent plunge of ViacomCBS stock as a result of the imploding of a ridiculously leveraged (read greedy) hedge fund (Archegos), which ostensibly threatened the solvency of more than one of the global financial institutions that provided the leverage. Credit Suisse, for example, will bleed a few $billion, while, not to mention, its head of risk management lost her job over the debacle.

My point to Nick was that these things tend not to be one-offs, and are also symptomatic of late-stage bubbly bull markets.

Guggenheim’s Scott Minerd agrees:

“It is highly likely that we are going to have another situation like that,” Minerd said Monday in a Bloomberg Television interview. Major losses, such as those incurred by Archegos, “tend to continue to cascade until the market corrects and flushes the risk out of the system,”

I have stated over and over again for the past year plus that there virtually has to be a plethora of Bernie Madoffs, Alan Sanfords, Enrons, Worldcoms, on and on, hiding in the present-day weeds. It’s the inevitability of extended bull markets, but, per Minerd above, it takes a serious correction (bear market) to flush em out.

Or, as Warren Buffett is fond of saying:

“You discover who’s swimming naked when the tide goes out.”

Of course, on full display, is a U.S. Central Bank that will go to the ends of the Earth in its attempts to keep the market ocean at high tide.

Europe’s Central Bank (ECB), on the other hand, may indeed be — believe it or not — beginning to actually set the stage for a bit of monetary tightening. Should the Fed even hint of following suit, you’ll — I can virtually assure you — see the stock market’s beach begin to seriously widen, in a hurry.

The ECB’s governing counsel stated the following this morning:

“If the economy develops according to our baseline, we will see better inflation and growth from the 2nd half onwards. In that case, it would be equally clear to me that from the 3rd quarter onwards we can begin to gradually phase out pandemic emergency purchases and end them as foreseen in March 2022.”

Make no mistake, the Fed will be issuing no such commentary anytime soon. They absolutely know the fix they’ve gotten us into, and they’ve zero stomach for nausea, particularly when they believe that they can convince us that the economy will remain in need of serious meds far into the foreseeable future.

Sharing a little more of our internal communication (with translation to follow).

Here’s something I posted in our research thread after my weekly analysis of the positioning of futures traders in (among others) the 23 contracts — ranging from the S&P 500 to the Russian Ruble — that I assess and record each week:

“Note: 4/3/2021: Russell 2k flipped to 10k net short, SPX added to net short, Nasdaq added to net short, USD added to net long, YEN added big to net short, VIX less net short:

It appears as though futures traders are, on net, expecting a selloff in equities (R2k, SPX, Nas, all moving notably more net short) against further rising rates (10-yr treas big net short move)…

I.e., traders are seeing all the stimulus as ultimately being market-negative due to the impact on interest rates at these crazy-high equity valuations, even with regard to stimulus-loving smallcaps… This is very precarious short-term positioning in my view — as it’s a good news is bad news setup… and the consensus seems all in on (economically-speaking) the “good news.”

I.e., if this is indeed the prevailing view, on any slight (as “significant”, or “extreme” would demand a different narrative altogether) moderation in the data — i.e., somewhat less reopening oomph than anticipated — rates will back off big, tech will rally big, taking the growthy trade along with it… I.e., shorts will get caught off guard… I.e., bad news is good news for growth stocks!

My view is that the dollar is technically ripe for a few weeks worth of decline; which could be positive for equities, as well as our gold, etc., positions…

Ultimately, the bond market understands that the fed has zero stomach for high yields, thus, at any hint of consequentially tightening conditions (other than a fed rate hike, which is entirely out of the cards for the foreseeable future), or less-robust growth, treasuries will rally (yields will decline) in a hurry… I.e., the former (rising yields) will force the Fed’s hand (ycc) or the latter will, by itself, serve to suppress yields…

If, on the other hand, futures traders have it right, and yields have further to go before the fed steps in — to, let’s say, 2% on the 10-year — yes, stocks are then sooner-than-later in for a world of hurt…”

Translation: “Smart money” is getting nervous (I get it), but — despite all of my own longer-term concerns — going short (betting on a collapse) right here is precarious. I.e., as counterintuitive as it is, if things don’t look like a Roaring 20s repeat right away, and rates come down, shorts on growthy stocks may get blown out as share prices rise. However, if indeed the economy explodes out of this, and the Fed is willing to give interest rates more upside room, then, you bet, the shorts will indeed (I suspect) see a very nice payday (i.e., stocks go down)!

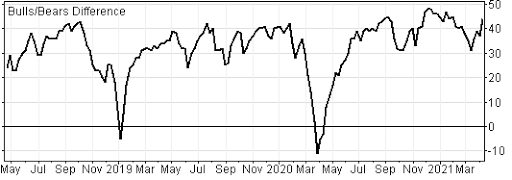

Lastly, while futures traders are either hedging their bets against, or aiming to bet profitably from, a fall in equities, investment advisors are all bulled up. Per the Investor’s Intelligence weekly advisor survey, which shows the spread between the bulls and the bears at an extremely high 44.1.

“The bull-bear spread expanded sharply to +44.1%, from +36.9% last issue. That dramatically increased the overall risk. Four weeks ago the difference (+30.4%) just missed falling out of the danger zone with the narrowed reading since the end of May-20, when it was expanding.

Now it is near the +48.0% spread shown late Nov-20. Above +30% counts show more risk the higher they get, with defensive measures signaled above 40%.

The spread was +41.5% in Jan-20, and +43.2% in late Sep-18, both times before major market declines.“

Thanks for reading!

Marty