You sure wouldn’t expect equity markets to be struggling right here (as they have this week) if all you did was check the sentiment data from around the world.

Yesterday’s Flash (preliminary) Purchasing Managers Indices (PMIs) — for Europe in particular — tell of an across the board rise in optimism, particularly in the manufacturing space:

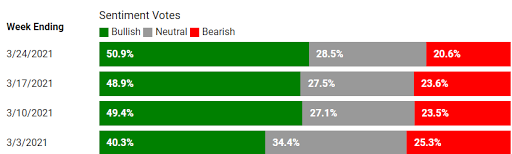

“The bull-bear spread expanded to +38.6%, from +36.3 last issue. That increase points to higher risk. Two weeks ago the count just missed falling out of the danger zone with the smallest difference since the end of May-20, when it was expanding. It reached +48.0% late Nov-20. Above +30% counts show more risk the higher they get, with defensive measures signaled above 40%. The spread was +41.5% in Jan-20, and +43.2% in late Sep-18, both times before major market declines.

Just something to keep an eye on…

Asian equities leaned green overnight, with 10 of the 16 markets we track closing higher.

European markets, on the other hand, are suffering so far this morning, with 16 of the 19 bourses we track in the red as I type.

U.S. major averages are off as well (although not to the degree we’re seeing across Europe): Dow down 119 points (-0.38%), SP500 down 0.20%, SP500 Equal Weight down 0.38%, Nasdaq 100 down 0.15%, Russell 2000 down 0.73%.

The VIX (SP500 implied volatility) is up 2.83%. VXN (Nasdaq 100 i.v.) is up 1.83%.

Oil futures are down 3.43%, gold’s up 0.32%, silver’s up 0.11%, copper futures are down 2.09% and the ag complex is down 0.36%

The 10-year treasury is up (yield down) and the dollar is up 0.17%.

MP (rare earth minerals miner), utilities, Asia-Pac equities, gold and verizon lead our 8 positive core positions that are bucking the U.S. equity trend so far this morning. The laggards, however — led lower by URNM (uranium miners), oil services, solar, energy and India — outnumber the gainers, and have us essentially flat (-0.05%) to start the session.

Our message yesterday was, given present conditions, an important one to take in. Here’s a snippet:

“…use diversification as a form of hedging. I.e., rather than simply dividing your portfolio among a basket of different U.S. stocks, spread your allocation globally and among asset classes that don’t correlate perfectly with the stock market.

And, therefore, divorce your attachment to the day to day gyrations in stocks. Proper asset allocation, under present circumstances, virtually assures that you’ll experience stretches where your results deviate markedly from U.S. stocks, in both directions.”

Have a great day!

Marty