We’ve been drawing comparisons here and there between the present setup and the 1930s since late 2019. Typically we’ll reference similarities in the overall debt setup. Less so in an equity market context. Nevertheless, while a great depression is highly unlikely to occur anytime soon, there are some similarities worth paying attention to.

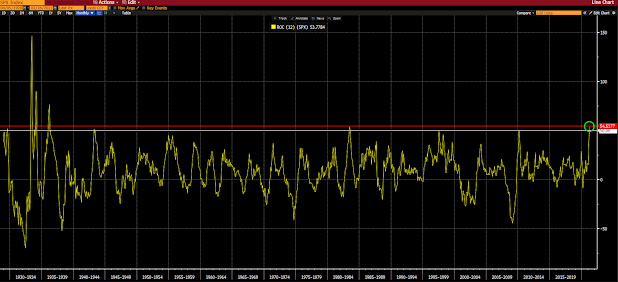

One happens to be the fact that, per the first graph below, the past 12-month rate of change for the S&P 500 is like nothing we’ve seen since, yes, the 1930s:

“…we must constantly, and painstakingly, crunch the data, study and chart the history, measure the thickness of the ice, take the outside temperature and, when it’s all said and done (which of course it never is), position according to our ever-evolving (along with ever-changing general conditions) risk/reward thesis…”

It’s just one small piece of the ginormous jigsaw puzzle that is the global economy and the financial markets.

Have a wonderful day!

Marty