Just a super quick macro update, catching up from the holiday.

Last week our proprietary index gave back 4.08 points, now sitting at -6.12. With 29% of its inputs scoring positive, 35% negative and 36% neutral.

Like I keep saying, underlying fundamentals are not remotely the drivers of stock prices these days.

Three of our inputs gave up a point:

Consumer Spending:

Personal Income:

And the Chicago Fed Nat’l Activity Index:

While one gained a point:

Durable Goods Orders:

There were two worth charting for you that didn’t see score changes:

Consumer Confidence (already receiving our lowest grade):

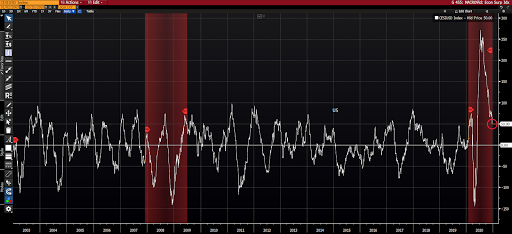

And the Citigroup Economic Surprise Index (tracks reported data against economists’ predictions). While still positive, the trend is concerning:

Bottom line: We’re still a ways from being out of the woods (economically-speaking).