Since this is your weekly “macro” update, I should probably mention jobless claims, which, at 885k last week would typically provoke visions of utterly desperate equity markets. But, as you’ve noticed, equity markets are presently not interested in anything fundamental…

Experienced friends, virtually without exception, tell me how there’s just no way that this ends well for stocks.

And, definitely, having a bit of experience in markets myself, I can’t help but 100% sympathize with my experienced pals.

That said, I always interject that while, yes, sentiment, valuations, chart patterns and history absolutely support that thinking, we nevertheless don’t know for certain that this chapter won’t indeed “end well” after all.

In this context of course “end well” means without a 60%+ collapse in stock prices.

However, in a holistic, long-term, capitalism sense, investors suffering the consequences of egregious risk-taking, one might argue, is the definition of ending as it absolutely should — which I’d argue can be defined as ending “well.” That is if you want markets to, at the end of the day, appropriately price risk.

Bottom line: We can’t know the future, be we can know the risk. Which is historically high at this juncture…

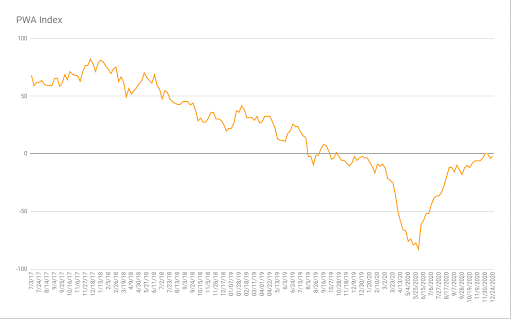

As for this week’s scoring of our macro index, jobless claims didn’t move our needle, being that they already garner our lowest score.

Otherwise, our index actually did finish the week with a net overall improvement, with one input (the Baltic Dry Index) gaining a point — the rest remaining as they were.

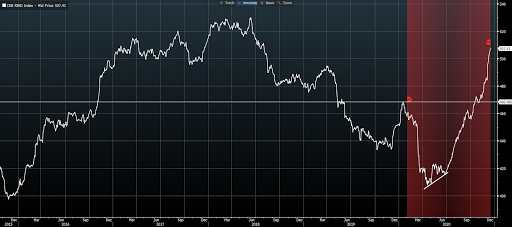

Baltic Dry Index (cost of dry bulk materials shipped across the world’s oceans):