We’ve given you lots to digest herein this wild week, so I’ll keep our macro update light on words and heavy on visuals.

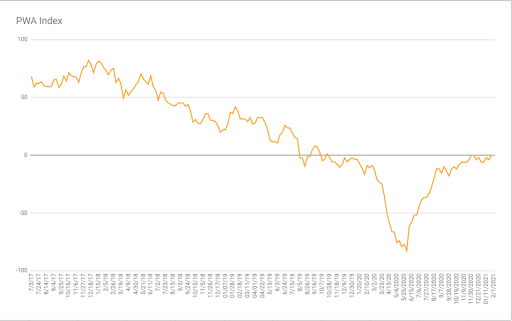

Our proprietary macro index came in — for the 2nd consecutive week — at 0.

Now don’t let that flatlined score fool ya, we saw plenty of movement in our inputs.

In terms of the score-changers, we had 2 pluses and two minuses:

The pluses:

Caterpillar Global Sales saw a smaller year over year decline (nearly an increase) for the 3rd month in a row:

Note that the heavy equipment maker is now seeing positive sales growth in Asia and Latin America (speaks to our global infrastructure thesis that we’re expressing more of in our updated core portfolio mix):

The Chicago Fed National Activity Index (a weighted average of 85 economic indicators) is our other improved indicator this week

The two that legged into lower scores were;

The Baltic Dry Index, which tracks the cost of shipping bulk materials across the world’s oceans (this week’s reading [while reflecting shipping capacity as well] does not support that global building narrative):

And our sectors/SP500 ratio analysis, where scores above 100 denote a given sector’s outperformance of the broad index, under 100 denotes underperformance.

Over the past month, 4 of the 6 cyclical sectors (tech, financials, materials and industrials) we track for this purpose have underperformed the S&P. While 2 of the 3 defensive sectors (utilities and healthcare) outperformed:

Other inputs whose numbers didn’t move the needle, but are still worth a look:

Consumer Spending (threatening to roll back over):

Consumer Savings Ratio (a surprise — if, that is, you’re in on the pent-up demand theme — uptick):

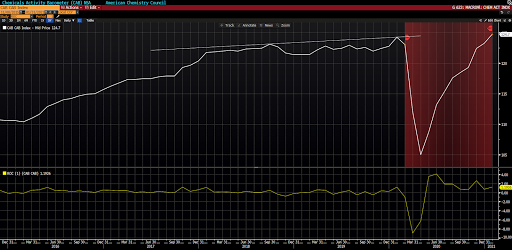

The Chemical Activity Index remains unambiguously positive with regard to manufacturing activity:

You want to see the LEI (leading economic index)/CEI (coincident economic index) ratio trending ever higher; it stalled month-over-month:

3 of our 4 standard inflation data points have turned higher (consistent with our present overall thesis):

Inflation breakevens (the spread between treasury note yields and treasury inflation protected note yields) presently send the same (rising inflation) signal:

As does the Bloomberg Commodity Price Index:

As well as the CRB Raw Industrial Materials Price Index:

As for inflation, indeed, it, in any sustainable fashion, seems a stretch — and some very good economists would tell you that I’m off base on this one (although there are others, equally good, who agree) — given the presently huge output gap (potential GDP vs current output).

In my view, however, supply constraints (having to do with more than just COVID), coupled with some (continued) rebound in activity (demand) going forward, and a monster amount of government spending (ultimately on infrastructure), and, not to mention, money printing galore, will indeed make for some real world inflation in the months ahead, at least at the margin…

Dave Rosenberg is one of those very good economists (excellent, in fact) who would take the other side of my inflation argument. Although we absolutely agree on the ever-growing heaviness of what is now a monster debt burden:

“The one thing that never gets discussed is how these massive deficits and debts that were amassed during the pandemic get resolved.The total debt-to-GDP ratio across the entire U.S. economy has ballooned to a record 365.5% from 326.7% before the crisis. In just three quarters, as much debt was added to the nation’s books as in the prior two decades combined.That number, in dollar terms, is $77.4 trillion or $620,000 per household. Contemplate that number.This overhang keeps getting bigger and bigger —at the height of the 2000 tech bubble, that liability was $260,000 per household and at the peak of the 2007 housing and credit bubble, that ratio was $475,000.”

Yes, ultimately, that sounds very deflationary! And I don’t disagree. My work, however, has me anticipating a perhaps extended inflationary impulse in the meantime. The latest data says just maybe I’m onto something.

There’s another scenario, by the way, where our two opinions could/may ultimately merge, that would be stagflation (read 1970s). Which is inflation occurring amid generally weak economic conditions… Hmm…

Have a nice weekend!

Marty