The investor sentiment story for quite awhile now has been one of virtual mass euphoria, which isn’t a stretch if you focus on the individual investor and investment advisor surveys. Our own “fear/greed barometer” last scored a -50: While not the -100 that would indeed be “mass euphoria”, it’s definitely lopsided toward the bull side of the boat.

The inputs that have kept our particular indicator from hitting max optimism suggest that there’s an area on the boat occupied by tourists who either see the ocean very differently than the partiers dancing on the rail, or perhaps see enough potential turbulence in the weather forecast to batten down their respective hatches a bit.

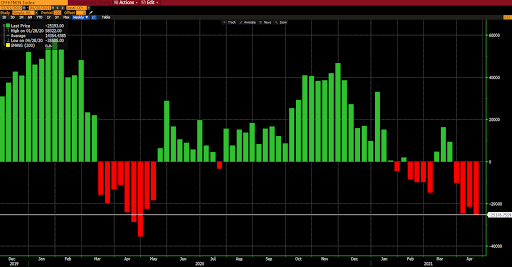

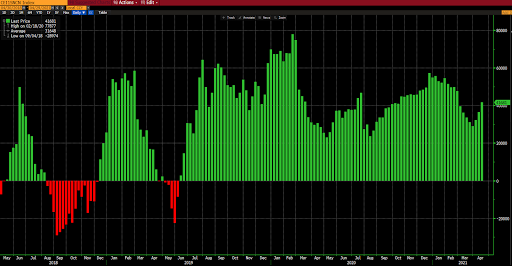

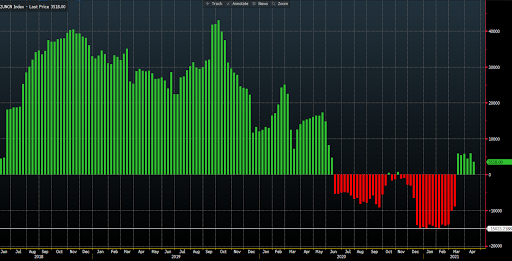

They would be the traders who occupy certain areas of the futures pit. Here are a few visuals that illustrate the net positioning of futures speculators in key markets (green bars denote traders being net long [bullish], red means net short [bearish]).

S&P 500

Note: 4/25/2021: (IMPLICATIONS IN TERMS OF ECONOMIC SENTIMENT): SPX jumped to most net short since late-February (BEARISH). 10-yr treasury moved from net short back to net long (BEARISH). Nasdaq still net short, but has declined in number of contracts for the 3rd straight week (NEUTRAL). Huge net short interest in smallcaps — Russell 2k net short highest since late-April 2020 (BEARISH). Gold remained notably net long (BEARISH). Silver net longs up for 3rd straight week, with big jump to 41,681 contracts last week (?). Copper net longs jumped notably, after declining for 7 straight weeks (BULLISH). Oil net longs up for first time in 3 weeks (BULLISH). Net longs on the dollar declined (NEUTRAL).

So, at least when it comes to futures speculators (and they’re no slouches), we don’t (at the moment) have quite the euphoria risk the headline surveys might suggest… Although, it’s definitely elevated enough (plenty) to keep an eye on…

As for the markets this morning, the U.S. major averages opened with a decent bang to the upside, although it’s fading as I type… I was going to say “don’t let the headline green fool you, there’s lots swimming in red under the surface.” Mainly (save for utilities) all things interest rate sensitive. And while the Nasdaq opened nicely green — thanks to Apple and Facebook earnings — half the stocks in the index were trading in the red. As I type, the index itself is now in the red with more than half of its constituents now declining.

Asian equities leaned green overnight (although they’re selling off in the U.S. session this morning), with 12 of the 16 markets we track closing higher.

Europe’s mostly red this morning, with 12 of the 19 bourses we follow trading lower thus far.

U.S. major averages are essentially flat to mixed: Dow up 1 point (0.00%), SP500 up 0.21%, SP500 Equal Weight up 0.26%, Nasdaq 100 up 0.18%, Nasdaq Comp down 0.09%, Russell 2000 down 0.31%.

The VIX (SP500 implied volatility) is up 3.76%, VXN (Nasdaq i.v.) is up 2.50%.

Oil futures are up 1.50%, gold’s down 0.91%, silver’s down 1.47%, copper futures are down 0.22% and the ag complex is down 0.24%.

The 10-year treasury is down big (yield up big) and the dollar is up 0.13%.

Led by uranium miners, AT&T, bank stocks, utility stocks and consumer staples stocks — but dragged by MP (rare earth miner), solar stocks, metals miners, ALB (lithium miner) and gold miners — our core mix is off 0.28% to start the day.

Clients and long-time readers would be 100% forgiven if they were to call me a skeptic, as they’d be mostly correct. In fact, per the following from Thomas Philippon’s The Great Reversal, I feel it’s my/our duty — as it has us forever digging through data, and even (especially) questioning/challenging our own theses:

“I have found that people who tell you that the answers to the big questions in economics are obvious are telling you only half of the story. More often than not, they think the answers are obvious either because they have an agenda or because they don’t really know what they are talking about.

So be skeptical— always. Most people simply repeat what they have heard without checking the data. In fact, there is often a negative correlation between outward certainty and factual information.”

Have a great day!

Marty