For this week’s main message I’ll point to two of the developments that are influencing our present macro thesis, then share some key highlights from our latest messaging.

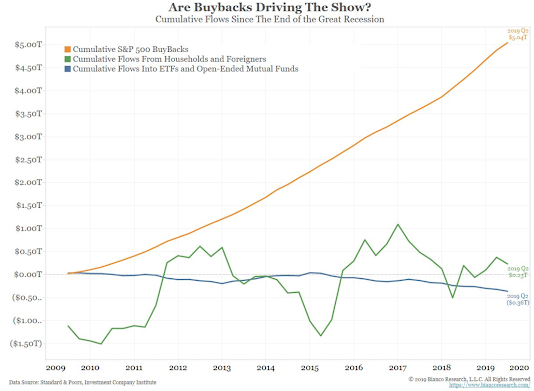

Toward the lead-in to last year’s blink-on-an-eye bear market in equities, I, on numerous occasions, pointed out that the bull market at the time was largely characterized by the fact that the only meaningful net buyers of stocks were the underlying companies themselves.

Here’s the chart I featured at the time (orange line = share buybacks):

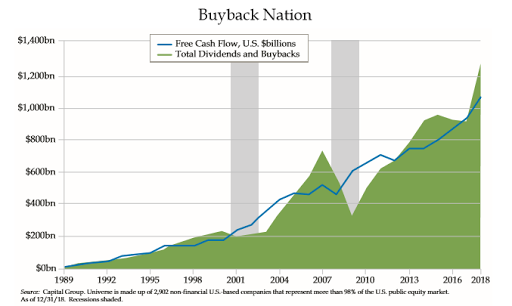

“Already this year, U.S. companies have authorized $504 billion of share repurchases, according to Goldman Sachs Group data through May 7, the most during that period in at least 22 years. The pace of announcements trounces even the 2018 bonanza that followed the sweeping tax overhaul of late 2017.”

“U.S. companies also ramped up dividend spending in the first quarter, data from S&P Dow Jones Indices show, increasing their payments by an aggregate $20.3 billion on an annualized basis. That marks the largest quarterly increase since 2012.”

Now, if you’re of the mind that stocks should just go up, always and forever, you’re loving this news!

If, however, you’re a macro-driven, big picture thinker/investor, you’re pausing right here and recognizing that the Fed not only saved markets (and egregious risk-takers) from hell last year, they did such a good job of it that that brief three-week brush with terror did virtually nothing in terms of quelling what is typically a late-stage hubris that has companies willing to spend their balance sheets (lever them up even) on what amounts to an outright smoke-and-mirror pumping of their own stock prices.

Speaking of their balance sheets, here’s more from that WSJ article:

“The increased desire among companies to spend comes as the U.S. economy is edging toward normalcy, and as executives are deciding how to deploy the cash hoard they amassed last year. Cash holdings among S&P 500 companies topped $1.89 trillion at the end of last year, according to S&P Dow Jones Indices, an all-time high and a nearly 25% increase from the end of 2019.

Many issued record-breaking amounts of debt to help bolster their balance sheets, too.”

“…while stuff like clothes, sporting goods, building materials, all things department stores, and even online sales all declined month-over-month, bars and restaurant sales rose 3%, after being up 13.5% the month prior.

You gotta wonder, after folks satisfy their pent-up demand for someone else’s cooking, what’s the retail landscape going to look like when they get back to those shiny new kitchen utensils (record sales of such occurred during lockdown) they actually learned how to use whilst their favorite restaurants were shuttered?

I mean, are stuff sales really going to rebound to offset what will be a letdown in, for example, eatery sales once those appetites are satisfied? That’s something we think about a lot these days!”

“…I suspect we’ll see inflation settle into a steadily rising structural trend, and in the process fuel what will likely turn out to be the next long-term commodity supercycle.”

“…before we settle into that structurally rising inflation scenario (if indeed that’s where we’re headed), I look for a notable calming of the thrust we’re presently experiencing — as the worst of the production bottlenecks subside — inspiring a chorus of I-TOLD-YOU-SOs from the “it’s transitory” camp.”

“As you can see (green trend lines on the 50-year chart below), commodity bull markets tend to last a very long time. This one — while, per my mentions in recent video commentaries, I anticipate a potentially notable (and healthy) correction in the not too distant future — is just getting underway:”

“Bottom line: The markets utterly own the Fed. And while selloffs in equities indeed get their attention, it’s the credit markets that ultimately keep them up at night. Raise interest rates and just see what happens to a bond market that sports yields so low, on even the absolute junkiest of debt (CCC-rated corporate bonds carry a 5 handle currently), that it’s become virtually unrecognizable…”

“”Don’t trust your intuition or what you think is true. These will be biased by your experiences, environment, and political persuasion. If you don’t have data, you don’t have knowledge.” –Euan Sinclair

I couldn’t agree more!”

Thanks for reading!

Marty