If I had a nickel for every time of late that I’ve referenced the 90s tech boom (then bust) while discussing the frenzy that’s going on in certain spots in today’s market, well… I’d need a suitcase to lug them around in.

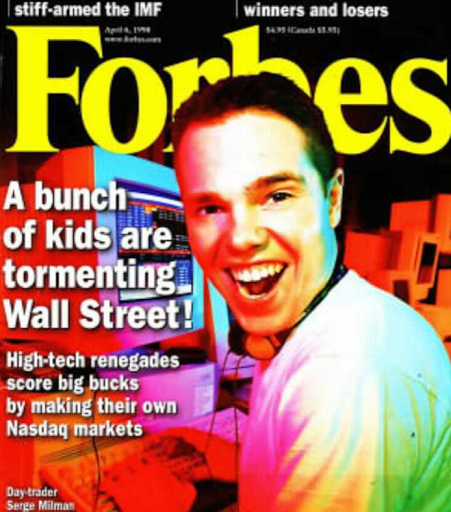

In his note this morning, economist Peter Boockvar sympathizes, and reminds us (via the 1998 Forbes cover below) of how the newbie traders of the 90s — SO much like today’s — really thought they had Wall Street’s number:

“So, I’ll never forget it. January of 2000 I go into Soros’s office and I say “I’m selling all the tech stocks, selling everything. This is crazy. This is nuts.” Just kind of as I explained earlier, we’re going to step aside, wait for the next fat pitch.

I didn’t fire the two gunslingers. They didn’t have enough money to really hurt the fund, but they started making 3% a day and I’m out.

It is driving me nuts. I mean their little account is up like 50% on the year. I think Quantum was up 7. It’s just sitting there.

So, like around March I could feel it coming. I just — I had to play. I couldn’t help myself. And three times during the same week I pick up a — don’t do it! Don’t do it!

Anyway, I pick up the phone finally. I think I missed the top by an hour.

I bought $6 billion worth of tech stocks, and in six weeks I had left Soros and I had lost $3 billion on that one play.

You asked me what I learned. I didn’t learn anything. I already knew that I wasn’t supposed to do that. I was just an emotional basket case and couldn’t help myself. So, maybe I learned not to do it again, but I already knew that.”

And, yes, alas, I’ve had one or two long-time, experienced clients seriously inquire about cryptocurrencies as well as what I consider to be the silliest stocks I’ve seen since, well, yes, 1999.

5 of the 16 Asian markets we track were closed overnight, of the remaining 11, 8 closed in the green.

Europe’s in good shape this morning, with all but 3 of the 19 bourses we follow trading higher thus far.

U.S equities are (save for smallcaps) struggling to start the day: Dow down 0.08%, SP500 down 0.10%, SP500 Equal Weight flat, Nasdaq 100 down 0.20%, Nasdaq comp up 0.07%, Russell 2000 up 0.69%.

The VIX (SP500 implied volatility) is up 2.68%. VXN (Nasdaq 100 i.v.) is up 4.81%.

Oil futures are flat, gold’s down 0.21%, silver’s down 0.08%, copper futures are down 0.72% and the ag complex is up 0.24%.

The 10-year treasury is down (yield up) and the dollar is down 0.11%.

Led by Mexican equities, uranium miners, ag futures, healthcare and utility stocks — but dragged by solar stocks, emerging market equities, metals miners, oil services and materials stocks – our core portfolio is off 0.09% to start the session.

Timeless wisdom from investing great Ray Dalio:

“The lesson? When everybody thinks the same thing—such as what a sure bet the Nifty 50 is—it is almost certainly reflected in the price, and betting on it is probably going to be a mistake. I also learned that for every action (such as easy money and credit) there is a consequence (in this case, higher inflation) roughly proportionate to that action, which causes an approximately equal and opposite reaction (tightening of money and credit) and market reversals.”

Have a great day!

Marty