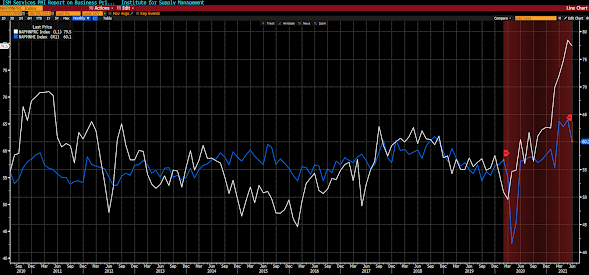

We looked at the following graph in last weekend’s video update:

“Our restaurants are quickly — maybe too quickly — returning to 2019 sales levels. Strong consumer demand for dining out is clearly evident as COVID-19 restrictions ease, but the challenges are supply chain outages, logistics delays and employee- and management-staffing constraints. Some locations cannot open for business or (have) limited hours, as we cannot staff the restaurant to meet consumer demand.” [Accommodation & Food Services]

“Severe supply chain disruptions and inflation are continuing in the marketplace, in all sectors.” [Arts, Entertainment & Recreation]

“COVID-19 continues to cause troubles for all of our deliveries, as well as short supply a lot of materials. (Shortages of) lumber, copper, and steel continue, which is driving up pricing and lead times.” [Construction]

“The declining positive test rates for COVID-19 is already having a significant impact, as virtually all aspects of our operations are picking up rapidly. The summer is normally the slow period, as limited teaching is taking place, but this year, preparations for the fall semester are already underway.” [Educational Services]

“New business is actively trending up locally, nationally and internationally.” [Finance & Insurance]

“We continue to see a high (patient) census as COVID-19 restrictions are eased, but the volumes are not pandemic related. There are more patients now because they wouldn’t or couldn’t get treatment because of restrictions on (non-COVID-19) care or personal cautiousness.” [Health Care & Social Assistance]

“Employees globally are returning to the office where possible. We expect to have most employees in the office starting in September.” [Information]

“Business conditions continue to rebound; however, like everywhere, the challenges in the supply chain are numerous. We continue to see cost increases, delayed shipments, pushed-out lead times, and no clarity as to when predictive balance returns to this market.” [Retail Trade]

“Labor market remains tight, and wages have risen at an unprecedented rate. We are expecting a long-term effect on pricing of services.” [Transportation & Warehousing]

“Overall business activity in the month has been strong. We are seeing increased orders and slight improvements in backlogs. The primary headwinds this month continue to be very expensive ocean freight rates, increasing business costs and increasing raw-materials costs. The top line is not outrunning expenses.” [Wholesale Trade]

“Starting to see a lot of commodity-price increases for chemicals, acidizing and cementing. This is driven by product cost increases stemming from low production from plants.” [Mining]

“We must operate with partial knowledge, and be provisionally content with probabilities; in history, as in science and politics, relativity rules, and all formulas should be suspect.

“History smiles at all attempts to force its flow into theoretical patterns or logical grooves; it plays havoc with our generalizations, breaks all our rules; history is baroque.” Perhaps, within these limits, we can learn enough from history to bear reality patiently, and to respect one another’s delusions.”

Have a great day!

Marty