Over the years I’ve devoted volumes herein and elsewhere expressing my concerns (well... complaining) over the folly of government intervention into the functions of the economy.

Well, I suppose it’s all fine and good to educate folks on (complain about) how the misallocation of resources (via government diktat) impacts the economy and the markets, in the end, however, our job here at PWA is to see the forest for the trees and, in the process, protect and grow our clients’ wealth.

With that in mind, here again (bolded where they comport with the above) are the traits that we believe define the world’s best portfolio managers:

1. A passion for macro economics and market history.

2. A firm understanding of intermarket relationships.

3. A firm grasp of global macro and geopolitical developments.

4. An obsessively strong work ethic.

5. The ability to transcend his/her ego and political preferences.

6. A willingness to buck prevailing market trends (diverge from the crowd) when the risk/reward setup inspires it.

7. An understanding of and appreciation for the uncertainty of markets.

8. A flexible and open mind.

9. Utter humility.

It’s certainly no secret to clients that we are now long-term bullish on inflation, and, therefore, inflation-sensitive assets going forward.

And, make no mistake, as we’ve discussed and illustrated, the incentives and constraints that have captured governments the world over — as well as the central banks of the most developed economies — support our position, in a big way!

Here, one more time, are the main bullet points from our longer-term inflation thesis:

- Increasing populism (a serious headwind for global trade — in both goods and labor).

- A continual stimulating of the economy via fiscal policy (facilitated by easy monetary policy) — demanded by a politically-powerful populist movement.

- China maturing into a service-oriented, consumer-driven economy (while moving away from providing cheap labor and goods to the outside world).

- The Fed’s fear of bursting present asset and debt bubbles were it to implement traditional inflation-fighting measures — thus willing to fall notably behind the inflation curve well into the foreseeable future. In fact, I personally place better than 50/50 odds that if indeed a long-term trend of rising inflation emerges, that the Fed will revert to yield curve control (buying up the price (down the yield) of longer-term treasuries) to control lending rates that, were they allowed to rise, would themselves produce a headwind to rising inflation.

- The trillions of dollar-denominated debt sitting on foreign corporate balance sheets inspiring an active campaign by the Fed to keep the dollar at bay, in an effort to avert what could otherwise turn into very messy global currency crises.

- The reticence of producers in the metals space to aggressively expand capacity despite rising prices: Speaks to the devastation they experienced post the ‘08 to ‘11 China building boom.

- Aggressive and exceedingly commodity-intensive global green energy ambitions.

- The political/environmental headwinds for fossil fuel producers to expand capacity.

- Inflation being the US’s historically-preferred mechanism for reducing heavy federal debt burdens.

While indeed there are risks embedded in the above, at the same time, investment opportunities abound!

Cases in point:

“…an oil field’s useful life is anywhere from 50 to 80 years. And these top 100 oil fields, by the early 2000s, were getting to be 50, 60 years old.”

So, despite aging oil fields, the environmental, social and political backdrop has us assuming that the future of the industry is more likely to be about being shareholder friendly (read share buybacks and dividends) with their capital than what you might otherwise expect given the pricing and production backdrop.

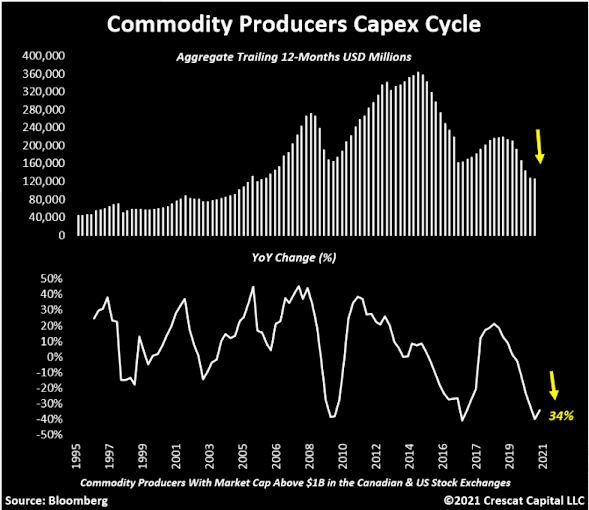

With regard to base metals producers; them having gotten, frankly, stupid a decade+ ago when China was building “ghost cities” — i.e., borrowing and expanding to the extreme — and suffering the inevitable market consequences of the come-down (shaded area below), suffice to say that we like the go-forward setup for what we view as an early-stage bull market in a now-profitable sector — particularly against that capex backdrop charted above:

S&P Metals and Miners Index March 2009 to current:

And speaking of base metals, a look at copper is most instructive…

Bloomberg’s Eddie van der Walt sufficiently captures our base case for all things copper going forward:

- The metal, used in electric wiring, is essential in the quest to decarbonize economies — and it’s much better placed for sustained price gains than other commodities that have come into vogue for the same reason..

- Unlike, say, lithium, humans have used copper for thousands of years, meaning much of the easily-accessible resources have been extracted. What’s left will be harder to reach and more expensive to mine.

- And demand for copper keeps rising. The industry needs to spend upward of $100 billion to close what could be an annual supply deficit of 4.7 million metric tons by 2030 as the clean-power and transport sectors take off, according to estimates from CRU Group.

- That would require building the equivalent of eight projects the size of BHP Group’s giant Escondida in Chile, the world’s largest copper mine.

- The metal is used in every step of the post-oil economy. Solar- and wind-power plants generate electricity, carried by copper wire through grids to homes and electric vehicles, which themselves use more than three times as much of the metal as ones that rely on internal combustion engines.

- Of course, eagle-eyed investors will note that oil outperformed copper by about 30 percentage points over the past year, perhaps suggesting that we mustn’t overestimate the pace of the pivot to a greener world.

- But crude is a sunset commodity, and this relative performance is a mirage caused by myopia.

- Over the longer term, the picture is different. From 2009 to 2014, a ton of copper cost as much as 78 barrels of crude. Between 2015 and 2019, that number jumped to over 100, and we’re up to 141 since the start of last year.

- The world is slowly shifting from oil to copper as the most important commodity in supplying our energy needs. Yet supply of the metal is limited. That creates a very bullish long-term picture.

And, speaking of the investment community, despite the fact that the setup we’ve described is no secret, government pension fund managers remain notably light in their allocation to commodities.

- Local politics in Chile and Peru will become critical to the global energy transition, particularly as regards the supply side of the most critical metal for this transition: copper.

- *Chile’s runoff elections next month will pit a former congressman portrayed as a hard-right candidate against a protest leader-turned-legislator in a battle for the presidency of a country that accounts for ~ 30% of global copper mining output.

*By the way, the “protest leader-turned-legislator” won…

- In Peru, which accounts for just over 10% of global copper production, the left-of-center administration indicated it will mediate talks to close two gold and silver mines, despite protests from its corporate owners.

- Tightly balanced supply-demand fundamentals will keep inventories of refined copper extremely low, which will slow the early-stage global transition to renewable power generation until these stocks can be replenished

we think we’ve sufficiently described why we’re including metals and minerals, and the companies that mine them in our core allocation.

“If our clients live their lives in comfort, if they go about their days without a financial worry, without reacting to or fretting over the inherent volatility of financial markets — if our commitment to them instills, or enhances, that sense of wellbeing — we are indeed successful as a firm.”

Happy New Year to You and Yours!

The PWA Team

Attention non-client subscribers, a reminder: Nothing on the blog should be construed as investment advice. The examples expressed relate to portfolio management we perform on behalf of our clients, and, again, under no circumstances are they to be considered recommendations to the reader.