This week’s headline read from our own macro index says the economy’s prospects continue to improve. Jumping 4 points as our sectors/SP500 ratios (call them market signals) leapfrogged neutral; going straight from negative to positive since our last assessment:

Financials/SP500 Ratio:

Energy/SP500 Ratio:

Industrials/SP500 Ratio:

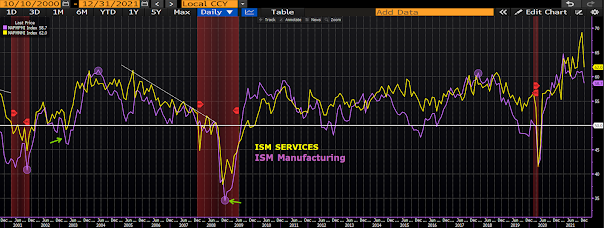

“The Prices Index reached its third-highest reading ever at 82.5 percent, up 0.2 percentage point from the November figure of 82.3 percent. Services businesses continue to struggle replenishing inventories, as the Inventories Index (46.7 percent, down 1.5 percentage points from November’s reading of 48.2 percent) and the Inventory Sentiment Index (registering 38.3 percent, up 1.9 percentage points from November) stayed in contraction or ‘too low’ territory in December.”

And what you don’t want to see is the above combined with this additional snippet from the services report:

“The Business Activity Index registered 67.6 percent, a decrease of 7 percentage points compared to the reading of 74.6 percent in November, and the New Orders Index registered 61.5 percent, 8.2 percentage points lower than the all-time high reading of 69.7 percent reported in November.”

While “stagflation” would be the word that describes a slowing economy amid rising inflation, we won’t jump the gun here, as above-60 scores denote continued strong growth…

As for the jobs picture:

While this morning’s nonfarm payroll number missed estimates by more than half (199k vs 450k estimated), the below-the-surface reality says give it zero worry at this point.

First of all, prior two months’ revisions added 141k. The household survey actually shows 651k new jobs, and that’s after a huge 1.1 million in November. The unemployment rate’s down to 3.9% (the U6 rate which includes “underemployed” and discouraged job seekers declined to 7%). Average hourly earnings rose (now +4.7% year-over-year). And ADP’s private sector report says 807k new jobs were added last month.

All that rosy jobs news aside, we’ll close here with 3 other worthy mentions that, while none remotely sparking fears of looming recession, have our attention:

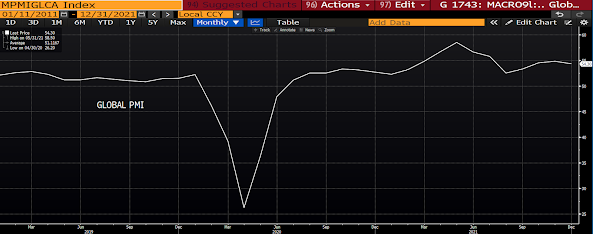

JPM’s Global Composite Purchasing Managers Index:

US Auto Sales: