Fed chair J. Powell has the pleasure of appearing before congress today for his reconfirmation hearing. While the gent is notorious for sparking equity market rallies when he has the spotlight, he’s no doubt feeling the intensity of its emitting heat as today’s topic will be all about inflation.

Oof! The “tools” that the Fed would utilize to quell inflation are, well… let’s just say they’re not what stock market bulls want to hear about — right about now.

Not to suggest that he won’t pull off another short-term save for stocks this morning, it’s just that, amid an inflation backdrop that is looking less “transitory” (his previous go-to excuse) as the days go by, well… if he really aims once again to bolster equities, we’re now talking strained credulity…

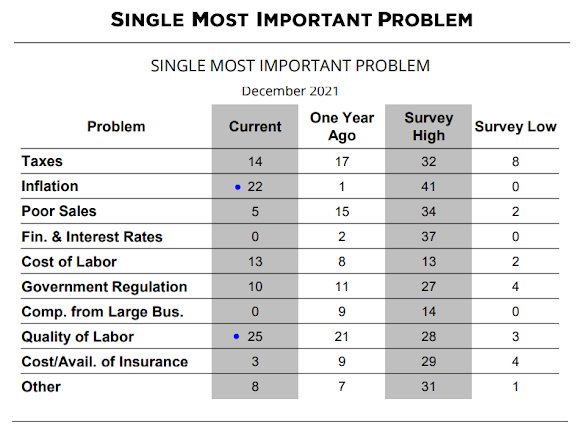

Speaking of inflation, here’s from this morning’s release of the December NFIB Small Business Survey:

“Small businesses unfortunately saw a disappointing December jobs report, with staffing issues continuing to impact their ability to be fully productive,” said NFIB Chief Economist Bill Dunkelberg. “Inflation is at the highest level since the 1980’s and is having an overwhelming impact on owners’ ability to manage their businesses.”

And while indeed quality of labor and inflation were respondents’ top two concerns,

“… built into the speculative episode is the euphoria, the mass escape from reality, that excludes any serious contemplation of the true nature of what is taking place.”

Have a great day!

Marty