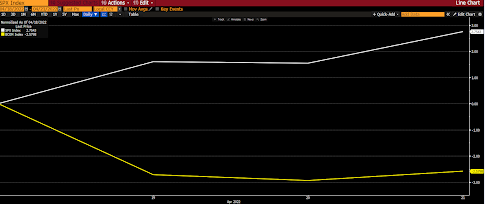

Indeed, stocks (down 5.32%) have a mountain to climb to catch commodities (up 32.57%), but a nearly 5+% spread +2.65% for stocks vs -2.60% for commodities) over just 4 days is definitely something to pay attention to. Particularly when 20% of your portfolio has direct exposure to the likes of crops, industrial and precious metals, and, not to mention, there’s some additional exposure by way of commodities producers stocks spread throughout (that would be us)…

Now, you video watchers, I did say in last week’s economic update that some corrective action is due for commodities. And, per our latest market snapshots, the near-term setup for equities has looked relatively bullish.

Longer-term, however, we remain structurally bullish inflation (although we see its rate of change softening over the coming months amid a potentially challenged macro backdrop [we even took a small position in bonds yesterday]), for a host of reasons — not the least of which being the massive demand for natural resources as a result of a global green energy push that has, at the end of the day, reached the point of no return…

I should add that China has backed itself into the proverbial corner, and is notorious for ramping up the infrastructure spending (whether it needs it or not) to fight its way out. Particularly when its autocratic leadership is looking for reappointment to another term come the second half of this year. That’s ultimately a bullish setup for commodities… and, not to mention, Chinese equities (down 36% over the past 12 months) heading into the second half of the year…

As for the broader US stock market longer-term, well, as we’ve illustrated, the technicals look concerning right here, and the macro backdrop is, well, we’ll call it “concerning” as well…

Let’s just say that this is no time to get cute with your money…

Asian equities were mixed overnight, with 8 of the 16 markets we track closing lower.

Europe’s in rally mode this morning, with all but 3 of the 19 bourses we follow trading up as I type.

US stocks are starting the day nicely: Dow up 223 points (0.62%), SP500 up 0.73%, SP500 Equal Weight up 0.48%, Nasdaq 100 up 0.99%, Nasdaq Comp up 0.93%, Russell 2000 up 0.14%.

The VIX sits at 20.09, down 1.13%.

Oil futures are up 2.43%, gold’s down 0.73%, silver’s down 2.27%, copper futures are up 1.21% and the ag complex (DBA) is down 0.16%.

The 10-year treasury is up (yield down) and the dollar is up 0.07%.

Among our 39 core positions (excluding cash and short-term bond ETF), 19 — led by AT&T, Verizon, tech stocks, Eurozone stocks and Disney — are in the green so far this morning. The losers are being led lower by solar stocks, uranium miners, MP Materials, silver and base metals miners.