Bespoke Investment Group began their latest weekly report with a riff:

“Been dazed and confused for so long, it’s not true…Lotsa people talkin’, few of them know…Don’t know where you’re going, only know just where you’ve been…” – Dazed and Confused, Led Zeppelin

Then proceeded to explore the thus far perplexing 2022. Their opening paragraph speaks to the hubris (bolded by me) that infects the investment community:

“We can’t think of many songs that better encapsulate 2022, but if you can let us know. Confusing has been an understatement as investors are faced with a barrage of back and forth moves and policy decisions that would make most fair-minded people scratch their heads. Despite the cross-currents, we hear a lot of confidence from both sides about what will go down in the second half, but even in normal times, let alone one of the trickiest economic backdrops any of us have ever experienced, few of them know.”

Clients have heard me — in our portfolio review meetings — acknowledge that this has to be the most challenging market setup of my 38-year career.

Now, to be clear, as said clients will attest, there’s not the least bit of “shrinking” in my delivery of that statement. Meaning, it isn’t intimidating, it’s just challenging — in that it demands the deepest probing of the data, the deepest thinking on historical analogs, and the deepest understanding of political and geopolitical incentives and constraints.

My point being — and make no mistake — acknowledging the challenges, and embracing the demands of such an environment, is our job — which, above all, requires humility.

Our technical analyses (pointing to very short-term probabilities) aside, it pains me when I hear a contemporary come off uber-confident in his/her “knowing” of the near-term (say, next 6 months) future of markets.

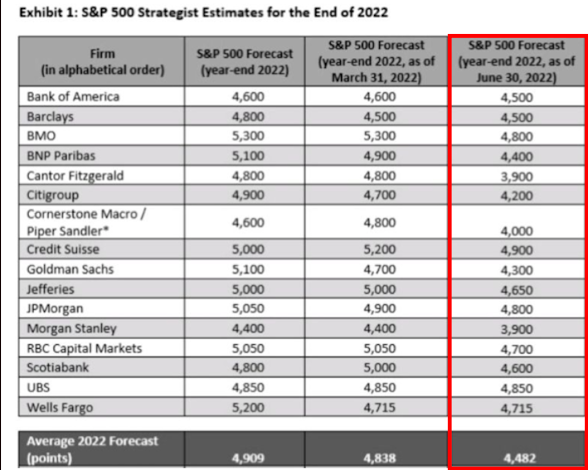

On the bull side, there’s (virtually always) Wall Street:

Asian equities, while getting hammered in the futures market this morning, were mostly green overnight, with 11 of the 16 markets we track closing higher.

Europe’s getting creamed so far this morning, with all but 1 of the 19 bourses we follow trading notably lower as I type.

US stocks are selling off to start the week: Dow down 557 points (1.75%), SP500 down 1.68%, SP500 Equal Weight down 1.84%, Nasdaq 100 down 1.17%, Nasdaq Comp down 1.25%, Russell 2000 down 2.14%.

The VIX sits at 29.28, up 9.66%.

Oil futures are down 4.91%, gold’s down 1.02%, silver’s down 1.75%, copper futures are down 4.07% and the ag complex (DBA) is down 1.60%.

The 10-year treasury is up (yield down) and the dollar is up a huge 1.28% (explaining the everything selloff so far this morning).

Among our 38 core positions (excluding options hedges, cash and short-term bond ETF), only treasury bonds are in the green so far this morning. The losers are being led lower by metals miners, MP Materials, Nokia, Eurozone equities and oil services stocks.

“Getting the market right, from here on out, is as much about the politics and geopolitics as it is about valuations, interest rates, and earnings. And yet, our epistemic community of financial professionals has no real framework with which to navigate this new paradigm.”

–Papic, Marko. Geopolitical Alpha (p. 13). Wiley. Kindle Edition.

Have a great day!

Marty