In Monday’s morning note I suggested the following:

“…when it comes to “headline” CPI, we may see very little, if any, relief, even in the monthly number, given that energy prices ramped higher in June. The “core” number, which excludes energy, is more likely to reflect any recent letup in inflation.”

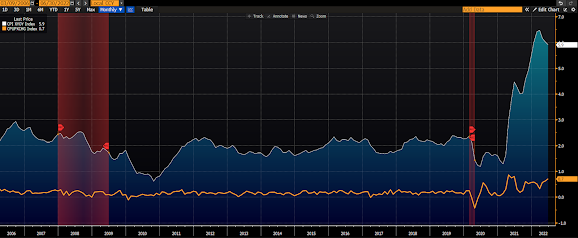

Well, suffice to say, we did not see “any relief” in the headline number. In fact quite the opposite:

However, it’s that orange line I bolded that throws cold hot water on that sentiment. That’s the month-on-month number that I said was the telling one to watch. And it’s telling us that the components in the core measure did not (as I wrongly anticipated) let up in June.

Equity futures are appropriately selling off as I type. I mean, given the shock of these numbers, and the support this gives for the Fed to go .75% at this month’s meeting, we should expect nothing less. In fact, suddenly, Fed funds futures are pricing in 30% odds of a full 1.00% hike this month.

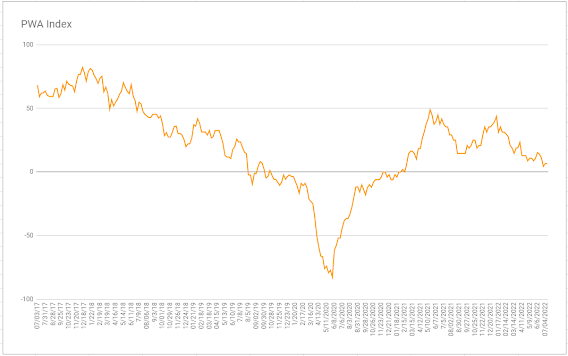

Now, let’s take a step back — and, by the way, recall that we are in the inflation will be higher for much longer camp — and chart the truly troubling items, and consider the fact that the inflation data was collected via thousands of calls on thousands of businesses throughout the entire month of June.

I red-Xed June 15th on each graph:

US average gasoline price:

Bloomberg Agriculture Spot Index:

Asian leaned red overnight, with 9 of the 16 markets we track closing lower.

Europe’s significantly in the red so far this morning, with 17 of the 19 bourses we follow trading down as I type.

Same for US stocks: Dow down 292 points (0.94%), SP500 down 0.87%, SP500 Equal Weight down 1.12%, Nasdaq 100 down 0.93%, Nasdaq Comp down 0.85%, Russell 2000 down 0.54%.

The VIX sits at 28.12, up 3.04%.

Oil futures are up 0.49%, gold’s down 0.02%, silver’s up 0.69%, copper futures are down 1.26% and the ag complex (DBA) is up 0.76%.

The 10-year treasury is down (yield up) and the dollar is up 0.21%.

Among our 38 core positions (excluding options hedges, cash and short-term bond ETF), 7 — led by energy stocks, ag futures, AMD, silver and base metals miners — are in the green so far this morning. The losers are being led lower by Disney, materials stocks, Sweden equities, uranium miners and financial stocks.

“…the swinging of conditions from one extreme to another in a cycle is the norm, not the exception.”

–Dalio, Ray. Principles for Dealing with the Changing World Order

Have a great day!