I featured the following chart in Tuesday’s must-watch video titled 7 Indicators That Warrant Caution Right Here.

By the way, the above was the picture before the world knew the banking sector had issues.

“It’s taken as read that this month’s banking fiasco will have an impact on lending and the transmission of credit, but perhaps it’s worth digging deeper. To some degree, for example, the expected tightening of credit has already occurred.

Over the last few weeks this column has noted that the flow of credit is likely to tighten significantly as a result of the

recent banking fiasco, and it seems as if the Fed agrees.

Indeed, it seems so self-evident as to be an article of faith,

but those sorts of easy assumptions can often be misplaced.

Anyone remember the “transitory” nature of inflation a few years ago? As such, it is worth checking one’s assumptions, or at least figuring out where to look to see how expected developments are going to unfold. A good place to start is the composition of loan assets on domestic banks’ balance sheets.

C&I LOANS | $2,312

RESIDENTIAL | $2,519

COMM RE | $2,820

CREDIT CARD | $968

AUTO | $519

OTHER CONS | $379

OTHER LOANS | $1,604TOTAL | $11,123

“The table above shows the loans held on the balance sheets of domestically-chartered commercial banks, with the amounts denominated in billions.

As you can see, real estate loans (combined residential and commercial) make up the largest cohort, followed by commercial and industrial loans, and then other various components, including credit card/revolving debt.”

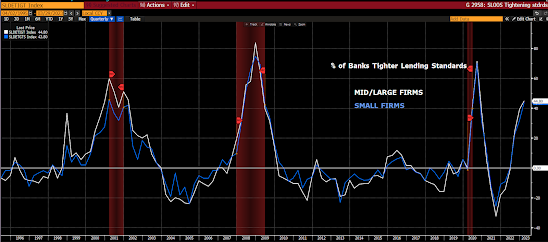

“Interestingly, bank lending standards have already tightened

substantially more than implied by IG or high yield credit

spreads. There is certainly room for that process to continue

when the next SLOOS is released, but on the other hand it is

reasonable to think that some of the impact feared from this

month’s bank-sector gyrations has already come to pass.

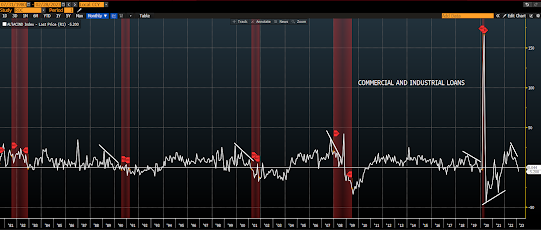

That being said, it is also reasonable to think that the tightening of standards has not yet been reflected in actual lending; the modeled six-month forward change in C&I lending is now negative for just the third time in the last two decades.

That is clearly a vector of vulnerability for the economy

moving forward and bears watching closely. C&I lending was at an all-time high in nominal terms in the Fed’s last H.8 release, so it’s not just deposits that we need to keep an eye on moving forward.”

So, yeah, as I continue to preach, it’s not the best risk/reward setup for risk assets right here.

Asian stocks were mostly green overnight, with 11 of the 16 markets we track closing higher.

Europe’s in rally mode so far this morning, with 18 of the 19 bourses we follow trading up as I type.

US equity averages are in the green to start the session: Dow up 137 points (0.43%), SP500 up 0.62%, SP500 Equal Weight up 0.84%, Nasdaq 100 up 0.69%, Nasdaq Comp up 0.70%, Russell 2000 up 0.82%.

The VIX sits at 19.11 down 0.05%.

Oil futures are up 0.79%, gold’s up 0.14%, silver’s up 0.95%, copper futures are up 0.63% and the ag complex (DBA) is up 0.80%.

The 10-year treasury is down (yield up) and the dollar is down 0.50%.

Among our 36 core positions (excluding options hedges, cash and money market funds), 33 — led by AMD, EWZ (Brazil equities), Dutch Bros, FEZ (Eurozone equities) and Amazon — are in the green so far this morning… The losers are JNJ, VNM (Vietnam equities) and VGIT (intermediate-term treasuries).

“Problems that are left unattended tend to become crises.” —Sir William Gascoigne

Have a great day!

Marty