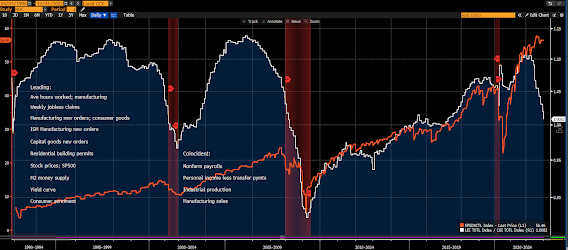

So, if there’s one graph (other than the one for our own index) that illustrates what has us not yet believing this year’s rally in equities, it’s this one (the Leading Economic Indicator/Coincident Economic Indicator Ratio):

Asian stocks were mostly lower overnight, with China shuttered this week for the lunar holiday… Japan, however, once again bucked the trend, with a 1.5% gain on the session.

Europe’s on its heels so far this morning, with 17 of the 19 bourses we follow trading down as I type.

US stocks are lower to start the session: Dow down 188 points (0.56%), SP500 down 0.70%, SP500 Equal Weight down 0.83%, Nasdaq 100 down 0.68%, Nasdaq Comp down 0.71%, Russell 2000 down 0.72%.

The VIX sits at 20.41, up 3.03%.

Oil futures are down 0.82%, gold’s down 0.68%, silver’s down 1.00%, copper futures are down 0.90% and the ag complex (DBA) is up 0.46%.

The 10-year treasury is down (yield up) and the dollar is up 0.22%.

Among our 36 core positions (excluding options hedges, cash and short-term bond ETF), only 4 — AT&T, Brazil equities, ag futures and treasury bonds — are in the green so far this morning. The losers being led lower by AMD, Dutch Bros, MP Materials, Albemarle and oil services companies.

“…there is a real economy and there is a financial economy, and the two are closely entwined but different.”

–Dalio, Ray. Principles for Dealing with the Changing World Order: Why Nations Succeed and Fail

Have a great day!

Marty