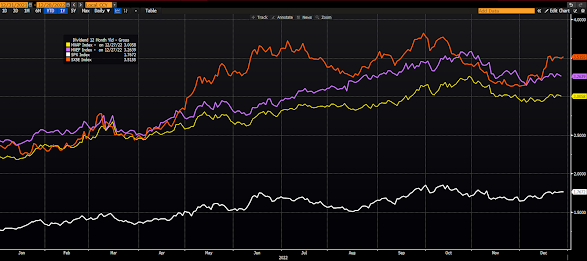

Dividend yield (the higher the better):

So, yes, in very simplistic terms, non-US equities have a marked edge over US equities — past the shaking out of the current bear market.

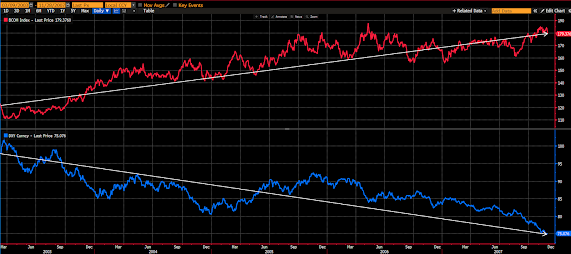

Getting a little deeper into the weeds, our long-term US dollar view (bearish), feeds that narrative as well.

Here’s the above with the dollar index (bottom panel) added.

The bull market in stocks that separated the tech and real estate bubbles:

The most recent bull market:

While a declining US dollar, by itself, is not bearish for US equities, it, as illustrated above, is indeed bullish for non-US equities — emerging markets in particular!

Same, typically, for commodities (although this year [shaded area in the next graph] has proved anomalous).

Period covering the most recent bull market in stocks (Red = Bloomberg Commodity Index, Blue = US Dollar Index):

Between the tech and real estate bubbles:

So what gives this year? How is it that the dollar and commodities have actually correlated positively for an extended period of time?

Well, for this year, it’s been all about interest rates… As the Fed pushed their benchmark rate higher (and as treasury yields rose), the rest of the world saw a serious opportunity to grab a notable interest rate differential (US rates vs their home currency rates)… Hence, the majors (Euro [which is the main driver of the USD index] and Yen) saw significant selling in favor of the dollar.

And thank goodness! Imagine the US inflation had the dollar actually tanked this past year… The otherwise perniciousness of a rising dollar (many call it a global “wrecking ball”) was, therefore, of little concern to the Fed… In fact, I suspect it was welcomed, given how far they fell behind the inflation curve.

Going forward, however, as (or if) recession pressures mount, and inflation abates, we believe the Fed will then welcome a falling dollar, as, on balance, it’ll improve the odds of achieving their desired economic “soft landing.”

So, while we do see a potentially not-small economic near-term headwind for our long-term commodity thesis, a declining dollar (along with China) could (as with regard to equities) serve to somewhat lessen the potential blow…

In a nutshell — keeping with our populism-driven/follow-the-government-spending theme — we want to lean into areas of the global economy that support a massive amount of infrastructure spending, both traditional (governments go there when they need to create jobs… plus, the US is falling sorely behind the rest of the developed world) and renewable energy, as well as position in a manner that takes advantage of a structurally higher inflation regime than we’ve grown accustomed to the past few decades.

Specifically:

US Equities: While remaining broadly diversified across sectors, we’ll maintain an emphasis toward industrials, materials and miners… Although, for the time being — due to our near-term recession thesis — consumer staples stocks remain a top position… Bottom line, we’re going to have to remain nimble as the next few months play out.

Non-US Developed Market Equities: Broadly diversified.

Emerging Market Equities: Emphasizing commodity producers over commodity consumers.

Commodities: We anticipate continuing to hold gold over the long-run… In a world awash in debt, where structural inflation pressures exist, there are huge constraints on developed central banks’ ability to hike interest rates to battle inflation (akin to the 1940s setup that we’ve exhaustively explored here on the blog these past couple of years)… In fact, we’d argue that inflation, when it’s all said and done, is the only way the US relieves itself of its current record debt to GDP ratio… I.e., inflate the economy faster than we increase the debt, which virtually demands the sort of capping of treasury rates (yield curve control) that the Fed of the mid-1940s was able to successfully pull off… Frankly, of all the long-term setups this one — elevated inflation/negative real interest rates — virtually has to be the best for gold…

Our weaker dollar thesis, volatile weather patterns and their attendant capacity challenges, has us remaining bullish on ag futures (DBA).

With regard to industrial commodities, our positions in DBB (base metals futures), materials stocks, energy stocks, silver and miners stocks are where we’ll continue to look to capture what we believe to be the obvious going forward.

Fixed Income: We took on moderate exposure to intermediate and long-term treasuries as they were in meltdown mode earlier this year… Our recession thesis has us looking at potentially increasing those positions in the near-term… We also recently rotated our cash position into a money market fund that is presently yielding approximately 4% annually… Beyond the near-term, we’ll likely end up shortening our overall duration in bonds, as interest rate risk (post-recession) will reemerge if our current thesis plays out as we expect.

Also, as the emerging markets we like turned up the heat on interest rates, far more aggressively early on than did the US, we took a position in EMB (emerging market bond ETF)… Considering the notable downside room those central banks now have to move their benchmark rates in a recession scenario, EMB’s 5% yield makes it extremely attractive to us going forward.

In terms of sizing, it’s all about our view of the go-forward risk-reward setup — overall and on a position by position basis… For now, we remain guarded — in fact, for the moment, some of our highest convictions appear a bit vulnerable to us, given our near-term concerns… Which may have us doing a bit of tactical hedging, as we did productively (in the aggregate) at times last year on certain positions, or, at a minimum, not adding to those positions until our risk/reward view improves — ideally (thinking long-term) we’ll catch them at bargain prices along the way…

I’m tempted to now regurgitate some of the deeper dives we took throughout 2022 (our various market and economic analogs, the minutia of our structural regime shift theory, the longer-term technical setup, and so on), but since I know we’ll be revisiting, updating and revising our narratives as needed herein over the coming weeks and months, I’ll bring this year’s final message to a close right here.

Folks, sincerely, we here at PWA can’t express enough how incredibly fortunate we are to have the opportunity to be of service to such a wonderful group of clients!! We are truly humbled by your trust and confidence! We appreciate you more than you know!

Wishing you and yours the very best in the new year!