This week will be, to put it mildly, interesting… CPI Tuesday, Fed decision and, most importantly, Powell’s press conference Wednesday, and then the largest options expiration of the year come Friday… Oh, and not to mention, the European Central Bank and the Bank of England both hold their policy meetings on Thursday.

Last Friday I illustrated what I called a — technically-speaking — short-term (the SP500 hourly chart) ambiguous look for US equities… But then I painted short-term technical pictures for the dollar (bullish) and for bonds (bearish) that were, based on this year’s correlations to stocks, giving an edge to the stock market bears heading into this week.

And from what I gather from the punditry — at least those whom I paid attention to the past few days — the experienced, active trader looks to be going in short.

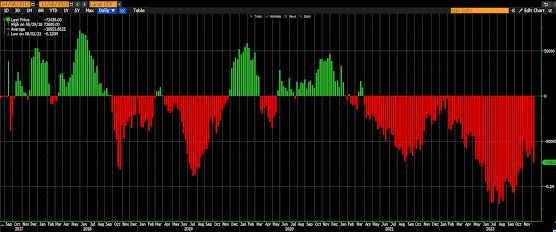

A look at speculator net positioning in equity futures — save for the Nasdaq — confirms that bearish feel:

SP500 E-Mini Futures Net Non-Commercial Traders Positioning:

Yep, that jibes with the present short-term technical setup.

Asian equities struggled overnight, with 12 of the 16 markets we track closing lower.

Europe’s off so far this morning as well, with 16 of the 19 bourses we follow trading down as I type.

US stocks are mixed to start the session: Dow up 115 points (0.34%), SP500 up 0.12%, SP500 Equal Weight up 0.13%, Nasdaq 100 down 0.05%, Nasdaq Comp down 0.02%, Russell 2000 up 0.07%.

The VIX sits at 24.44, up 7.05%.

Oil futures are up 2.25%, gold’s down 0.44%, silver’s down 0.62%, copper futures are down 1.88% and the ag complex (DBA) is up 0.26%.

The 10-year treasury is up (yield down) and the dollar is up 0.02%.

Among our 36 core positions (excluding options hedges, cash and short-term bond ETF), 23 — led by energy stocks, treasury bonds, uranium miners, cyber security and tech stocks — are in the green so far this morning. The losers are being led lower by Brazil equities, Vietnam equities, emerging market equities, base metals futures and base metals miners.

“The human propensity to choose short-term enjoyment over long-term well-being naturally exaggerates the highs and lows of the cycle because it pulls the good times forward at the expense of the future.”

Dalio, Ray. Principles for Dealing with the Changing World Order

Have a great day!

Marty