Before you go celebrating the higher (record breaking!) retail sales numbers for this holiday season vs last, know that we’re talking nominal, as opposed to real, terms (i.e., not counting vs counting inflation).

For example, online spending for Black Friday rose 2.4% (to a record-breaking number) compared to last year… But recall that consumer inflation (last reading) is up 6.3% (and that doesn’t count food and energy)… So, in real terms, online spending was actually down 3.9% this year… In other words, the volume of sales was, in reality, lower than last year

Overall, the National Retail Federation is estimating 6-8% growth this year vs last, so call it flat… Adobe expected yesterday (“Cyber Monday”) to beat last year’s results by 5% (i.e., a net decline, on a real basis).

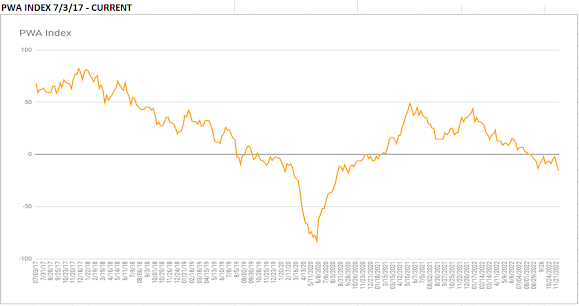

This jibes with the latest reading of our PWA Index (be sure to take in Friday’s video, if you happened to have missed it), which — at -15.56 — anticipates recession at some point over the coming months:

Which isn’t the best news for stocks going forward… Although, while the short-term setup has indeed gotten somewhat sketchy right here (don’t miss tomorrow’s video snapshot), I have to point out that seasonality still favors the bulls.

Powell’s speech at Brookings this Wednesday, Personal Consumption Data (and PCE inflation) this Thursday, and Friday’s jobs numbers could all be serious needle movers.

Stay tuned…

Asian equities rallied overnight, with 12 of the 16 markets we track closing higher.

Europe’s mostly green as well so far this morning, with 11 of the 19 bourses we follow trading up as I type.

US stocks are mixed to start the session: Dow up 27 points (0.08%), SP500 up 0.09%, SP500 Equal Weight up 0.19%, Nasdaq 100 down 0.04%, Nasdaq Comp up 0.08%, Russell 2000 up 0.23%.

The VIX sits at 22.32, up 0.50%.

Oil futures are up 2.93%, gold’s up 0.54%, silver’s up 1.89%, copper futures are up 0.86% and the ag complex (DBA) is up 0.33%.

The 10-year treasury is up (yield down) and the dollar is up 0.01%.

Among our 36 core positions (excluding options hedges, cash and short-term bond ETF), 26 — led by Brazil equities, base metals miners, Vietnam equities, MP Materials and our emerging market equity ETF — are in the green so far this morning. The losers are being led lower by Dutch Bros, utility stocks, long-term treasuries, water stocks and intermediate-term treasuries.

“…the specific manner by which prices collapsed is not the most important problem: a crash occurs because the market has entered an unstable phase and any small disturbance or process may have triggered the instability.”

–Sornette, Didier. Why Stock Markets Crash

Indeed! Which is why the most important thing we do here at PWA is to constantly study general conditions.

Marty