So, what to write about on day-1 of the Fed policy meeting?

How about p/e ratios relative to interest rates, or interest rates relative to inflation, or earnings prospects relative to recession risk, or mild recession risk vs deep recession risk, or interest rate differentials among countries vs their respective currencies (and if that’s forever the be-all-end-all of what drives them), or the fact that Powell can’t do a Volcker given the present-day debt setup, or that the Fed can’t slay inflation without hiking rates significantly higher, or the fact that the Fed can’t raise rates significantly higher without seriously breaking something in the credit markets (again, can’t be Volcker), and, by extension, the equity markets, or yada, yada and yada.

Well, of the list, the one that most hugs present-day market reality, frankly, is that last item: The fact that the Fed can’t raise rates significantly higher without seriously breaking something!

The question for markets being, how close are they to breaking something?

I.e., what the Fed feels is the vicinity of a break will guide their tone coming out of this week’s meeting.

Clearly, in our view, the recent UK debt market’s brief brush with implosion was a serious wakeup call — that, we know, based on the immediately softer tone coming from Fed members who, up till then, billed themselves as hardcore inflation fighters…

Further evidence the Fed was fretting came from the hinting from the Wall Street Journal columnist who’s known to be the Fed’s go-to when they want to send a signal to the market, without, that is, directly sending a signal to the market.

Here’s a tweet from said columnist (Nick Timiraos) just over a week ago:

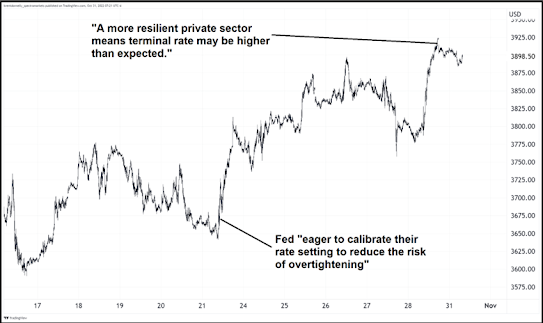

Fed “eager to calibrate their rate setting to reduce the risk of overtightening.”

And off (up!) went stocks!

I guess the “problem” is, up went stocks… I don’t mean to say that the Fed wants to crash the stock market, but I do mean to say that they don’t want it barreling into new all-time-high territory right away either… I.e., that’s akin to easing financial conditions, which may be how you avert financial crisis, but it’s definitely not how you go about fighting inflation… Moderation in markets is more to their liking right here.

So, here, per the chart below (offered up by trader and author extraordinaire Brent Donnelly), we are — a nice ways above where we were on the day of that “risk of overtightening” tweet… Hence, Mr. Timiraos threw this one out late last week:

“A more resilient private sector means terminal rate may be higher than expected.”

SP500:

While the latter, in my view, isn’t as hawkish as the former is dovish, it does suggest that the recent rally, and improvement in some key financial stress indicators we track, has the Fed feeling a little less fearful heading into this week’s meeting…

Stay tuned…

Asian equities were mostly green overnight (rumors of an official “reopening plan” and further inspection into the US’s “chips ban” [not nearly as draconian as originally billed] saw Chinese equities scream higher), with 10 of the 16 markets we track closing higher.

Europe’s in rally mode so far this morning, with 18 of the 19 bourses we follow trading up as I type.

US stocks are up to start the session: Dow up 229 points (0.70%), SP500 up 0.93%, SP500 Equal Weight up 0.97%, Nasdaq 100 up 1.21%, Nasdaq Comp up 1.33%, Russell 2000 up 0.75%.

The VIX sits at 25.76, down 0.46%.

Oil futures are up 2.62%, gold’s up 1.24%, silver’s up 3.65%, copper futures are up 3.04% and the ag complex (DBA) is up 0.50%.

The 10-year treasury is up (yield down) and the dollar is down 0.60%

All of our 35 core positions (excluding options hedges, cash and short-term bond ETF) — led by MP Materials, silver, base metals miners, emerging market equities and base metals futures –are in the green so far this morning.

“I’m deeply sick of most academics, their narrow theories, their ethics (the absence of them), their arrogance, their biases, and lack of creativity and humor. I’m sick of library rats; of people who tell you that a bureaucrat is a practitioner; of people who tell you that Marcus Aurelius wasn’t a philosopher. I’m sick of anyone who thinks he’s able to understand our complex world via reading papers.”

Andrei, Vizi. Economy of Truth

Have a great day!

Marty