For short-term traders, tomorrow’s jobs number is a big deal!!

While intuitively you’d think that a good jobs number would be good for stocks, well… not when the Fed is hellbent on slowing the economy in its efforts to cool inflation… I.e., a hot jobs number may make believers out of traders who — the past few days anyway (even yesterday, while closing slightly lower, saw an impressive rally off of the day’s lows) — have essentially said “we dare you” in response to the following (yesterday) from the Fed:

“SF Fed President Daly (“I’m not seeing signs of market dislocation” and “I aim to hike rates and hold, don’t see a rate cut in 2023”) and Atlanta Fed President Bostic (regarding 2023 rate cuts “not so fast”; warnings against “prematurely” reversing course).”

Fed funds futures say the cuts will indeed come as early as Spring 2023:

Hmm….

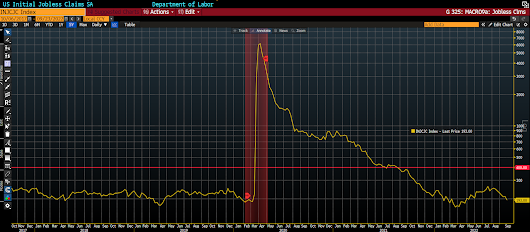

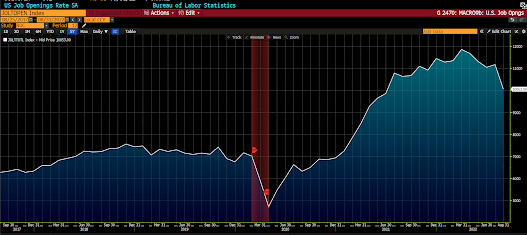

As for the prospects for tomorrow’s jobs report, personally, I don’t even want to go there with a prediction… But I will point out that Wednesday’s ADP print was slightly better than expected, and that weekly jobless claims continue to seriously impress, while, on the other hand, job openings are declining rapidly:

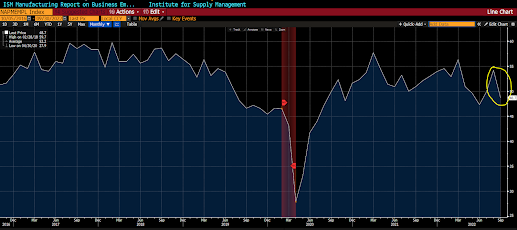

And from ISM Services (jobs picture improving):

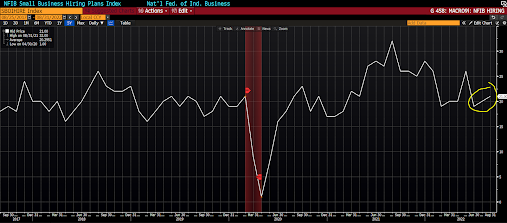

And form the latest NFIB Small Business Survey (hiring plans increasing):

So you can see why I ain’t goin there with a prediction… With regard to the market selling off on “good” jobs news, that very much makes sense to me… That said, remember, we’re coming into a typically-strong stretch of the year, off of quite the 2-month selloff, amid what has been a great deal of pessimism (crowd’s weighing down the bear side of the boat), yada yada.

Asian equities mostly rallied overnight, with all but 4 of the markets we track (China’s markets are closed this week) closing higher.

Europe, on the other hand, is mostly lower so far this morning, with only 4 of the 19 bourses we follow trading up as I type.

US stocks are mixed to start the session: Dow down 62 points (0.21%), SP500 down 0.08%, SP500 Equal Weight down 0.03%, Nasdaq 100 up 0.12%, Nasdaq Comp up 0.13%, Russell 2000 up 0.11%.

The VIX sits at 28.95, up 1.40%.

Oil futures are up 0.08%, gold’s down 0.06%, silver’s down 0.23%, copper futures are down 0.03% and the ag complex (DBA) is down 0.35%.

The 10-year treasury is down (yield up) and the dollar is up 0.54%

Among our 35 core positions (excluding options hedges, cash and short-term bond ETF), 15 — led by Dutch Bros, AMD, MP Materials, Albemarle and our semiconductor ETF — are in the green so far this morning. The losers are being led lower by AT&T, utilities stocks, Eurozone equities, Sweden equities and Nokia.

‘Wherever the ways of man are gentle, there is commerce, and wherever there is commerce, the ways of men are gentle,’ observed Charles, Baron de Montesquieu.”

Have a great day!

Marty