Check this out…

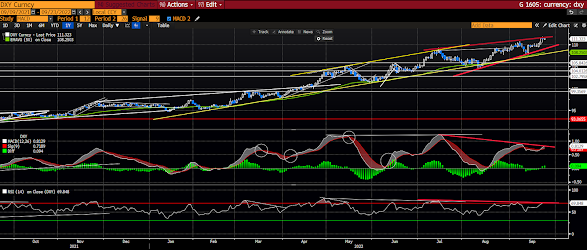

The circled area in the graph below captures a notable move in the futures market night before last:

“Notwithstanding, with downside protection that’s short-dated charged on this recent move lower, there lies the potential for a sharp move higher, toward $4,000.00 SPX, where Nomura’s Charlie McElligott was recently quoted saying “market makers are ‘long’” a leg of a large JPMorgan collar trade.

As we stated this AM, too, if markets move to above $4,000.00, then the negative gamma will die off and volatility should reduce, but markets should remain very fluid (i.e. volatility high) under $4,000.00.

Still, a shift lower would worsen the above negative gamma chase. In such a case, $3,600.00 is a key level to watch.”

Stay tuned…

Asian equities followed US’s lead overnight, with all but 1 of the 16 markets we track closing lower.

Europe’s ugly so far this morning as well, with 18 of the 19 bourses we follow trading down as I type.

US stocks are once again lower to start the session: Dow down 341 points (1.14%), SP500 down 1.29%, SP500 Equal Weight down 1.30%, Nasdaq 100 down 1.08%, Nasdaq Comp down 1.20%, Russell 2000 down 1.51%.

The VIX sits at 28.23, up 3.22%.

Oil futures are up 5.09%, gold’s down 1.33%, silver’s down 2.96%, copper futures are down 3.44% and the ag complex (DBA) is down 1.67%.

The 10-year treasury is up (yield down) and the dollar is up 0.76%

Among our 35 core positions (excluding options hedges, cash and short-term bond ETF), only 1 (along with our put hedges of course) — long-term treasuries — are in the green so far this morning. The losers are being led lower by MP Materials, energy stocks, Brazil equities, base metals miners and uranium miners.

“Japanese Yen: +99 percent The Japanese yen’s 1999 performance was a resounding attack on conventional theories indicating that rising or high interest rates boosted currencies, while low or falling interest rates were negative for currencies.

In 1999, Japanese short-term rates started the year at a postwar low of 0.25 percent—already the lowest among G7 economies—before being cut to 0.15 percent. Instead, the yen was boosted by a surge of global funds into Japanese stocks with the notion that Japanese markets were set to gain the most from the global recovery story, especially that Japan’s main equity index Nikkei-225 was drifting at 12-year lows in October 1998. The notion of cheap bargain stocks in the world’s second-largest economy during a global boom was the underlying theme to the yen recovery.”

“…tumbling Japanese equities reached 12-year lows in September 1998, prompting investors to seek bottom-fishing opportunities in Japanese stocks.”