This morning’s jobs number was certainly not a whiff! Coming in at 372k (vs 265k expected), although the prior two months were revised down by 74k. The unemployment rate remained at 3.6%, average hourly earnings bumped up .3% on the month and labor force participation dipped .1% to 62.2.

The 2-year treasury yield jumped on the news, signaling that it’s a go for another .75% rate hike come this month’s Fed meeting.

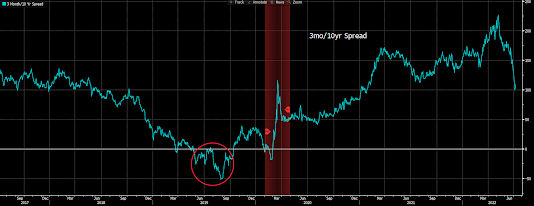

About that 2-year treasury yield, it presently trumps the 10-year by .04%… i.e., the “2s/10s curve” is inverted.

An inverted yield curve (everybody’s favorite recession signal) essentially says that the market expects the Fed to cause a recession… i.e., that the Fed will indeed succeed in its stable prices mandate (quell inflation). But, ultimately, despite today’s number, fail with regard to its full employment mandate (i.e., recession and rising unemployment are synonymous)… Hmmmmm…

Here’s a look at the 2yr/10yr yield spread dipping below zero:

I’ll say it again: Hmmmmm….

Back to jobs, here’s where they showed up (directly from the report):

Employment in professional and business services continued to grow, with an increase of 74,000 in June. Within the industry, job growth occurred in management of companies and enterprises (+12,000), computer systems design and related services (+10,000), office administrative services (+8,000), and scientific research and development services (+6,000). Employment in professional and business services is 880,000 higher than in February 2020.

In June, leisure and hospitality added 67,000 jobs, as growth continued in food services and drinking places (+41,000). However, employment in leisure and hospitality is down by 1.3 million, or 7.8 percent, since February 2020.

Employment in health care rose by 57,000 in June, including gains in ambulatory health care services (+28,000), hospitals (+21,000), and nursing and residential care facilities (+8,000). Employment in health care overall is below its February 2020 level by 176,000, or 1.1 percent.

In June, transportation and warehousing added 36,000 jobs. Employment rose in warehousing and storage (+18,000) and air transportation (+8,000). Employment in transportation and warehousing is 759,000 above its February 2020 level.

Employment in manufacturing increased by 29,000 in June and has returned to its February 2020 level.

Information added 25,000 jobs in June, including a gain of 9,000 jobs in publishing industries, except Internet. Employment in information is 105,000 higher than in February 2020.

In June, employment in social assistance rose by 21,000. Employment continued to trend up in child day care services (+11,000) and in individual and family services (+10,000). Employment in social assistance is down by 87,000, or 2.0 percent, since February 2020.

Wholesale trade added 16,000 jobs in June, including 8,000 in nondurable goods. Employment in wholesale trade is down by 18,000, or 0.3 percent, since February 2020.

Mining employment rose by 5,000 in June, with a gain in oil and gas extraction (+2,000). Mining employment is 86,000 above a recent low in February 2021.

Employment showed little change over the month in other major industries, including construction, retail trade, financial activities, other services, and government.

Now, when we dig below the surface and, for one, consider the details of this weeks job openings report, we can sense a subtle shifting of the underlying labor market tide that gibes with other data suggesting that the economy may indeed be on the cusp of a potentially significant slowing…

Asian equities were mostly higher overnight, with 12 of the 16 markets we track closing up (albeit modestly).

Europe’s leaning green so far this morning, with 10 of the 19 bourses we follow trading higher as I type.

US stocks are struggling: Dow down 111 points (0.35%), SP500 down 0.51%, SP500 Equal Weight down 0.76%, Nasdaq 100 down 0.62%, Nasdaq Comp down 0.57%, Russell 2000 down 0.53%.

The VIX sits at 25.70, down 1.46%.

Oil futures are up 0.23%, gold’s up 0.20%, silver’s up 0.18%, copper futures are down 1.38% and the ag complex (DBA) is up 0.90%.

The 10-year treasury is down (yield up) and the dollar is up 0.02%.

Among our 38 core positions (excluding options hedges, cash and short-term bond ETF), 11 — led by ag futures, healthcare stocks, Dutch Bros, solar stocks and uranium miners — are in the green so far this morning. The losers are being led lower by MP Materials, base metals miners, AT&T, Disney, and AMD.

“Business managers regularly extrapolate from the past to the future but often fail to recognize when conditions are beginning to change from poor to better or from better to worse. They tend to identify turning points only after the fact. If they were better at sensing imminent changes, the abrupt shifts in profitability that happen so often would never occur. The prevalence of surprise in the world of business is evidence that uncertainty is more likely to prevail than mathematical probability.”

Amen! (emphasis mine)

Have a great day!

Marty