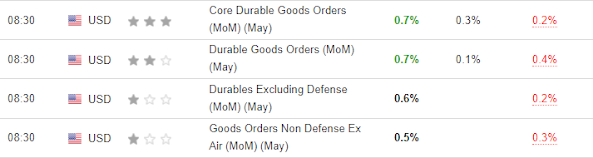

In yesterday’s economic update we featured a handful of inputs to our index that as of yet don’t rhyme with the recession-imminent chorus. This morning’s durable goods numbers add another to that list:

Now, to be clear, our overall score is about as low as it gets without denoting that recession risk trumps continued expansion going forward — lower than during the past mid-cycle-slowdowns I’ve pointed to in recent updates. So we may very well be joining the recession choir before the current setup plays itself out… but can’t go there just yet…

The economists and Fed-heads who reject the notion that recession is nearly upon us tend to cite the very large quantity of cash and savings that rests on the balance sheets of US consumers. But here’s the thing, per Bespoke Investment Group: emphasis mine…

“Midweek, the Federal Reserve updated its Distributional Financial Accounts, which include summaries of asset levels by income and type.

70% of Post-COVID Liquid Asset Boom Accrued To Top 20%

• Since the COVID crisis hit in Q1 2020, households have collectively seen their total “cash” assets (checking account, time and deposit account, and money market funds) rise by about $4trn.

• A large majority of that increase is concentrated among the income bracket least likely to spend that “excess savings” with the top quintile of households by income accruing fully 70% of the total increase.”

I.e., Yep, that liquidity is still in the system, just (the majority of it) not where it gets put to the kind of use that reflects positively on quarterly GDP numbers.

That said, that 30% is nevertheless meaningful:

“• The bottom quintile has actually seen a decline in checking account balances since Q4 ‘19, though total liquid asset balances (including time and deposit accounts as well as money market funds) for that income quintile are up about 10%.

• We note that liquid asset increases are so large that they overwhelm inflation for all but the lowest income quintile; even the fourth quintile income bracket has seen checking account balances triple since the end of 2019 and those balances are still at record levels as well as rising.”

Stay tuned…

Asian equities rallied overnight, with 14 of the 16 markets we track closing higher.

Europe’ catching a bid so far this morning; 11 of the 19 bourses we follow are in the green as I type.

US stocks are off a bit to start the week: Dow down 46 points (0.15%), SP500 down 0.24%, SP500 Equal Weight down 0.28%, Nasdaq 100 down 0.53%, Nasdaq Comp down 0.48%, Russell 2000 up 0.06%.

The VIX sits at 28.16, up 3.42%.

Oil futures are down 0.72%, gold’s up 0.22%, silver’s down 0.68%, copper futures are up 0.25% and the ag complex (DBA) is down 0.87%.

The 10-year treasury is down (yield up) and the dollar is down 0.23%.

Among our 38 core positions (excluding options hedges, cash and short-term bond ETF), 13 — led by uranium miners, energy stocks, carbon credits, Latin American equities and solar stocks — are in the green so far this morning. The losers are being led lower by Dutch Bros, Disney, MP Materials, ag futures and AMD.

“In all countries throughout time (though in varying degrees) people find themselves within “classes” either because they choose to be with people like them or because others stereotype them as part of certain groups.”

–Dalio, Ray. Principles for Dealing with the Changing World Order: Why Nations Succeed and Fail

Have a great day!

Marty