So, when you think about the big event of the week — the Federal Reserve May Policy Meeting — going on today and tomorrow, what you’re thinking about is the institution’s impact on financial conditions. Are their policies fostering loose and easy conditions (plenty of liquidity and low interest rates), or tight conditions (low, or less, liquidity and rising interest rates)?

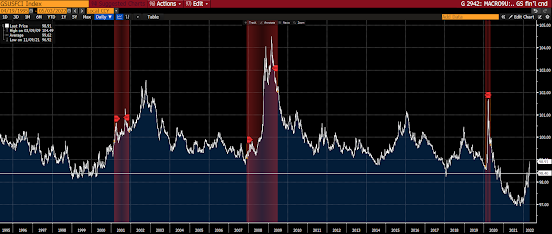

Well, circa November of last year, the Fed’s stance took an abrupt turn from what many, yours truly included, consider the primary reason for what has been history’s greatest bull market in stocks — that would be their on-balance uber-easy policy stance over the period.

I.e., inflation — the likes of which hasn’t been seen in 40 years — had them changing their tune from one that promised to protect asset prices at virtually all costs to one that promised to slay the inflation dragon, markets be damned (well, we’ll see)…

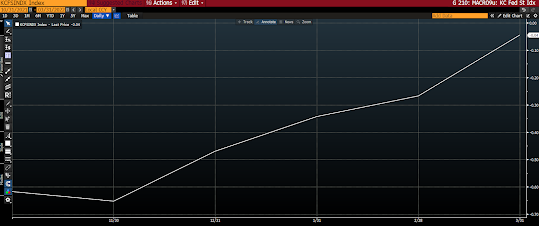

Among the components of what we affectionately refer to as the PWA Financial Stress Index are the following 4 financial conditions barometers (a rising line denotes tightening financial conditions):

The Chicago Fed Financial Conditions Index:

The Goldman Sachs US Financial Conditions Index

Asian equities struggled overnight, with 9 of 13 open (3 were shuttered) markets we track closing lower.

Europe’s nicely green this morning, with 17 of the 19 bourses we follow trading higher as I type.

US stocks are a bit mixed to start the day: Dow up 26 points (0.08%), SP500 up 0.26%, SP500 Equal Weight up 0.53%, Nasdaq down 0.27%, Nasdaq Comp down 0.13%, Russell 2000 up 0.55%.

The VIX sits at 31.10, down 3.83%.

Oil futures are down 0.96%, gold’s up 0.77%, silver’s up 0.90%, copper futures are up 0.97% and the ag complex (DBA) is up 0.14%.

The 10-year treasury is up (yield down) and the dollar is down 0.45%.

Among our 39 core positions (excluding cash and short-term bond ETF), 34 — led by carbon credits, oil services companies, solar stocks, uranium miners and MP Materials — are in the green so far this morning. Our 5 losers so far this morning are Mexican equities, Disney, tech ETF, staples ETF and base metals futures.

“In my view, the greatest way to optimize the positioning of a portfolio at a given point in time is through deciding what balance it should strike between aggressiveness and defensiveness. And I believe the aggressiveness/defensiveness balance should be adjusted over time in response to changes in the state of the investment environment and where a number of elements stand in their cycles.”

–Marks, Howard. Mastering the Market Cycle: Getting the Odds on Your Side

I couldn’t agree more!!

Have a great day!

Marty