In yesterday’s morning note (and last Thursday’s video) I mentioned that our own sentiment indicator recently turned positive, meaning, on net, fear presently reigns over greed among market players in the aggregate. Yes, that’s contrarianly positive…

Having been out Friday through Sunday, I’m now catching up on my regular weekend research.

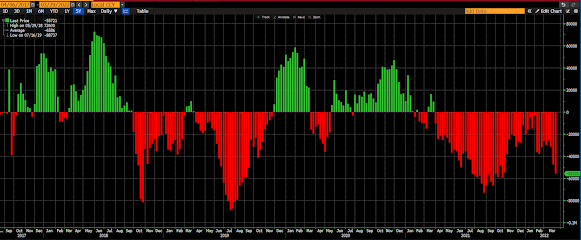

One thing that jumps out at me is the on-balance net bearishness among futures speculators who dabble in equity market futures. Confirming that growing-fear sentiment…

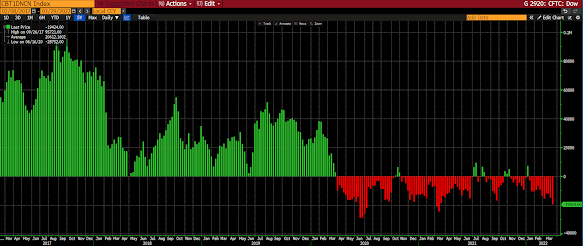

Which jibes with what we’re gathering is a general “fade-the-rally” sentiment captured by, for example, a continued bearish divergence in “on-balance volume” (bottom panel) for the S&P 500:

Stay tuned…

Asian equities (China shuttered) were mixed overnight, with half the markets we track closing lower.

Europe’s leaning green so far this morning, with 7 of the 19 bourses we follow trading higher as I type.

US stocks are mixed to start the session: Dow up 162 points (0.46%), SP500 up 0.15%, SP500 Equal Weight up 0.20%, Nasdaq 100 down 0.83%, Nasdaq Comp down 0.82%, Russell 2000 down 0.44%.

The VIX sits at 19.41, up 4.31%.

Oil futures are flat, gold’s up 0.40%, silver’s up 1.28%, copper futures are up 0.20% and the ag complex (DBA) is up 0.69%.

The 10-year treasury is down (yield up) and the dollar is down 0.03%.

Among our 37 core positions (excluding cash and short-term bond ETF), 22 — led by uranium miners, solar stocks, silver, base metals futures and metals miners — are in the green so far this morning. The losers are being led lower MP (rare earth miner), semiconductor stocks, ALB (lithium miner), Eurozone stocks and US tech stocks.

“The smart investor looks for opportunities to acquire value on the cheap, with one eye out for a dynamic change in the offing that might make that investment even more valuable.”

–Rogers, Jim. Hot Commodities. Random House Publishing Group.

Of course defining “cheap” is the challenge…

Have a great day!

Marty