Just a quick look at the technicals and a report on the early-session action across markets this morning. My plan is to get Part 2 of our year-end letter out to you by the weekend.

Well, the “decent” short-term technical setup that I charted for you on December 5th played out as suggested:

Here’s the 2-hour SP500 chart snipped from that video:

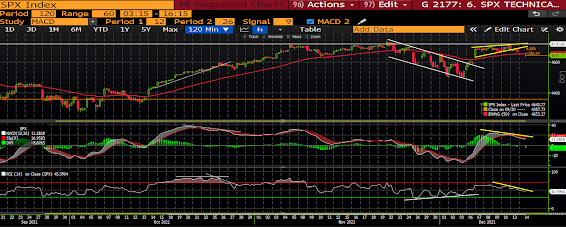

And here it is updated to this morning with last week’s breakout circled:

Now, before I mark up the updated chart and suggest where near-term probabilities may take the index, allow me to preface by saying that doing a short-term technical analysis ahead of a Fed policy announcement is probably a fool’s errand — or, at a minimum, let’s say it wouldn’t be anything to act on.

Suffice to say that the 2-hour chart heading into this week was not constructive; still isn’t. Note the yellow lines showing momentum (bottom 2 panels) diverging from price (top panel) — which is currently breaking below the trend line:

Jumping to the 6-month daily chart, while last week’s breakout of the recent down trend was encouraging, yesterday’s action — which amounts to a third engulfing candle (recall that pattern from the video), at precisely the spot of the previous two — well, suffice to say that a “triple top” emphasized by three engulfing candles is not the least bit a bullish technical setup. Nor are the negative divergences in the momentum indicators:

But hey! It’s only mid-December, and “buy-the-dip” has been very much alive and well to this point. So, indeed, that typical Santa Claus rally still has time to play out.

Good thing we’re long-term investors!

Our year-end message is where we’ll dig into the stuff that really matters…

Asian equities struggled overnight, with 12 of the 16 markets we track closing lower.

Europe’s a mess this morning, with all but 2 of the 19 bourses we follow in the red, as I type.

US major averages are trading lower (tech notably): Dow down 159 points (0.45%), SP500 down 1.12%, SP500 Equal Weight down 0.56%, Nasdaq 100 down 1.74%, Nasdaq Comp down 1.71%, Russell 2000 down 0.43%.

The VIX sits at 22.21, up a concerning 9.16%.

Oil futures are down 1.42%, gold’s down 0.65%, silver’s down 1.46%, copper futures are down 0.12% and the ag complex is down 0.01%.

The 10-year treasury is down (yield up) and the dollar is up 0.13%.

Led by banks, Verizon, metals miners, AT&T and Latin American equities — but dragged by solar stocks, MP (rare earth miner), carbon credits, ALB (lithium miner) and tech stocks — our core portfolio is off 0.38% to start the session.

I’m sure I’ve offered up the following in a past post or two, but it’s timely given the corner policymakers have presently backed themselves into:

“…investors (and anyone interested in forecasting politics) should focus on material constraints, not policymaker preferences.

Preferences are optional and subject to constraints, whereas constraints are neither optional nor subject to preferences.”

Have a great day!

Marty