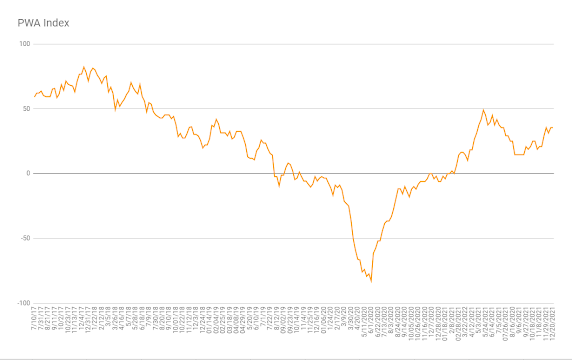

110k more than expected housing starts and a generally better look to our sectors/SP500 ratios (financials, materials and energy outperforming the broader average of late) were offset by weakening small business expansion plans and a notable outperformance of consumer staples over consumer discretionary stocks (muddies the sector/SP500 results). Therefore, our PWA Macro Index broke even on the week:

PWA Index

US Housing Starts

Financials/SP500 Ratio (1-month daily chart)

Materials/SP500 Ratio (“)

Energy/SP500 Ratio (“)

NFIB Capex Plans

Consumer Staples/Discretionary Ratio

Other notables:

US jobless claims ticked up to 206k, but that’s still historically low.

Homebuilder sentiment improved (from 83 to 84).

Despite the decline in those reporting plans to expand, the overall optimism read from the NFIB Small Business Survey saw a slight uptick (from 98.2 to 98.4).

Factory Capacity Utilization continues to rise:

Freight shipments are on the rise (top panel), and, alas, so are shipping costs (bottom panel):

We’ll let this US Producer Price Index graph speak for itself!

We’ll do the same for US Import Prices:

And for US Export Prices:

There’s plenty more, but we’ll close here with the following:

We mentioned yesterday morning that, unlike the Fed, the ECB and the BOJ, Latin American central banks are taking inflation very seriously. And — per rate hikes this past week from the central banks of England, Norway, Russia and Hungary — others are as well.

So what do they know that the US, Eurozone and Japanese monetary policymakers don’t? Frankly, I’d say zero! They’re simply not as utterly obsessed with (constrained by) their respective securities markets as are those three bigs.

Yes, their respective size and idiosyncrasies come with different, if not lesser, constraints, but, again, bottom line; inflation right here is a serious longer-term thing, regardless of what those who “can’t” seriously tackle it would have you conveniently believe.

Have a great weekend!

Marty