We’ll make this week’s main message a highlight fest from our past week of messaging:

“…there’s nothing here that says inflation is broadly coming off the boil just yet. Now, it certainly will as bottlenecks ease, but, as I keep repeating, our long-term thesis calls for a weaker-trending dollar and somewhat higher long-run inflation than we’ve become accustomed to these past several decades.”

“…even some at the Fed are starting to come around to our way of thinking. Here’s from Atlanta Fed Governor Rafael Bostic in a speech yesterday at the Peterson Institute:

“…it is becoming increasingly clear that the feature of this episode that has animated price pressures—mainly the intense and widespread supply chain disruptions—will not be brief. Data from multiple sources point to these lasting longer than most initially thought. By this definition, then, the forces are not transitory.”

Well not so fast, previous to my cherry-picked quote above, he did say the following:

“I think “episodic” better describes these pandemic-induced price swings. By episodic, I mean that these price changes are tied specifically to the presence of the pandemic and, once the pandemic is behind us, will eventually unwind, by themselves, without necessarily threatening longer-run price stability. In this sense, then, we might anticipate the prices of rental and used cars, lumber, and other demand-specific items to revert toward their prepandemic levels. Indeed, we have seen the beginnings of such reversions, which some could take as evidence that the use of that word is correct and fully appropriate.”

Now, we have maintained all along that there is indeed a hugely “episodic” (“transitory” even) nature to what we’re seeing, and that indeed prices will abate as bottlenecks loosen. It’s beyond that that we believe deeper evolutionary forces have odds favoring structurally higher inflation in the years to come.”

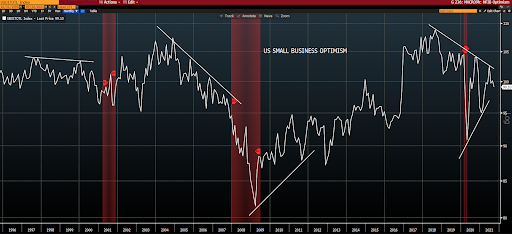

“Zeroing on the US; here’s the intro to this morning’s release of the September NFIB Small Business Survey:

“The NFIB Small Business Optimism Index decreased one point in September to 99.1. Three of the 10 Index components improved, five declined, and two were unchanged.

“Small business owners are doing their best to meet the needs of customers, but are unable to hire workers or receive the needed supplies and inventories,” said NFIB Chief Economist Bill Dunkelberg. “The outlook for economic policy is not encouraging to owners, as lawmakers shift to talks about tax increases and additional regulations.”

Key findings include:

- The NFIB Uncertainty Index increased five points to 74.

- Owners expecting better business conditions over the next six months decreased five points to a net negative 33%.

- Fifty-one percent of owners reported job openings that could not be filled, a 48-year record high for the third consecutive month.

- A net 42% of owners reported raising compensation, a 48-year record high.”

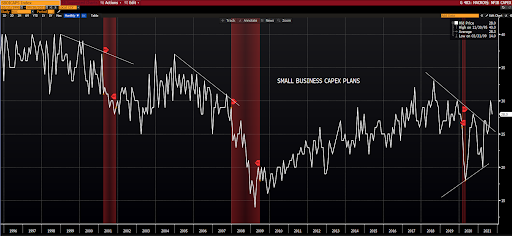

Being that small businesses employ the majority of us Americans, we take this data seriously. It accounts for 3 of our 48 macro index inputs:

Overall optimism:

Hiring plans:

Capex plans:

“With the bond market shuttered and no major data releases or earnings reports this morning, there’s not much to cover on this side of the pond.

Well, then again, there is the price of oil, which now fetches over $80/barrel! We’ve mentioned plenty herein how there simply won’t be the expansion of fossil fuel production capacity that $80 and a growing global economy might otherwise inspire. That said, there are for sure plenty of existing wells that can be turned back on as, yes, there’s money to be made at $80. Baker Hughes just reported the 5th week in a row of rising rig counts, and we should expect refining capacity to expand (come back) going forward, coming off of hurricane and, not to mention, COVID constraints.

We do remain bullish on oil well into the future, but I suspect it’ll be a somewhat bumpy road from here. We went ahead and booked some profits in the space over the past couple of weeks. Still own plenty…”

“Bassman: It’s like, what are we going to do? We’re not going to change their minds. So now with the situation we have, how are we going to invest, protect ourselves, try to make money, be clever… most of all, not get our hands chopped off by a surprise?

While, indeed, the Fed’s utter lack of stomach for market stress makes for epic moral hazard, in our view it gives us some real clarity going forward.

As we continue to stress, the Fed simply can’t support the equity market, the credit market and the dollar ad infinitum. I.e., something’s got to give. And that something in our view has to be the dollar. Which makes the overall (long-term!) setup very favorable for foreign (emerging market in particular) equities, industrial materials (given the direction of fiscal policy going forward), commodities and related equities, and precious metals far into the foreseeable future.

As for the very short-term, well, like I keep saying, we feel very good about our present allocation over the next 5 years. As for the next 5 weeks, or 5 months, however, I dunno.

And, yes, we think it’s critically important right here to hedge against getting “our hands chopped off by a surprise”…”

“Here’s from last Tuesday’s blog post, where I also touch on the hit from rising energy prices to corporate bottom lines and, thus, to the economy:

“In our portfolio discussion yesterday Nick and I pondered the coming earnings season. The key question: How are companies going to handle their forward guidance when so many are hamstrung by lack of necessary materials, components and such?

The Auto industry for example:

That nasty-looking chart has far more to do with the lack of components (chips in particular) than it does lack of demand for cars.”

“At first blush this morning’s jobs number looked like a big bust; 194k net jobs added vs 500k expected.

At second blush, however, it was fine:

For starters, July’s and August’s numbers were revised up by a total 169k. The issue for September was a notable decline in public education jobs, which economists are chalking up to confused seasonal calculations relative to what occurred last year. The private sector came in at 317k, which, when factoring in prior months’ revisions, wasn’t far from expectations. And then there was the ADP (payrolls) number reported Wednesday (up 568k).

Average hourly earnings rose 0.6% (that’s big), while the average workweek rose to a 4-month high of 34.8 hours.

The wage and hours worked data reflect the challenges employers are facing in attracting and retaining workers, which flies in the face of arguments suggesting today’s number reflects economic weakness.”

Thanks for reading!

Marty