The opening sentence from this week’s release of the Fed’s Beige Book* echoes the story we’ve been telling of late. That is, recession risk remains low, but growth is slowing:

“Economic activity grew at a modest to moderate rate, according to the majority of Federal Reserve Districts. Several Districts noted, however, that the pace of growth slowed this period, constrained by supply chain disruptions, labor shortages, and uncertainty around the Delta variant of COVID-19.”

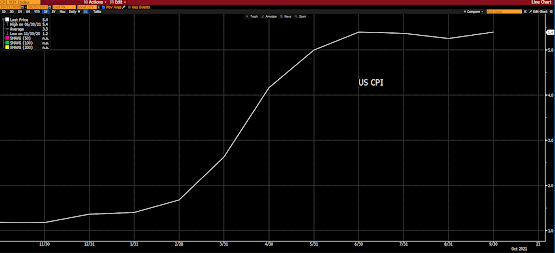

That’s a setup that has the term “stagflation” (rising inflation amid a stagnating economy) finding its way into a few narratives. We won’t go there just yet, but, sure, it’s a risk…

These two graphs, for the moment, argue that risk:

The Atlanta Fed GDP Nowcast (“GDPNow forecasting model provides a “nowcast” of the official estimate prior to its release by estimating GDP growth using a methodology similar to the one used by the U.S. Bureau of Economic Analysis):

Consumer Price Index:

“It is only when we begin to interpret, to translate according to our conditioning, according to our prejudice, that we miss the truth. After all, it is like research. To know what something is, what it is exactly, requires research—you cannot translate it according to your moods.”

–Jiddu Krishnamurti

Have a great day!

*Commonly known as the Beige Book, this report is published eight times per year. Each Federal Reserve Bank gathers anecdotal information on current economic conditions in its District through reports from Bank and Branch directors and interviews with key business contacts, economists, market experts, and other sources. The Beige Book summarizes this information by District and sector. An overall summary of the twelve district reports is prepared by a designated Federal Reserve Bank on a rotating basis.