Suffice to say that, while we see low recession odds on the foreseeable horizon, overall economic sentiment is clearly waning.

On the global front, the IMF published its latest World Economic Outlook this morning.

Here’s the intro: emphasis mine…

“The global economic recovery is continuing, even as the pandemic resurges. The fault lines opened up by COVID-19 are looking more persistent—near-term divergences are expected to leave lasting imprints on medium-term performance. Vaccine access and early policy support are the principal drivers of the gaps.

The global economy is projected to grow 5.9 percent in 2021 and 4.9 percent in 2022, 0.1 percentage point lower for 2021 than in the July forecast. The downward revision for 2021 reflects a downgrade for advanced economies—in part due to supply disruptions—and for low-income developing countries, largely due to worsening pandemic dynamics. This is partially offset by stronger near-term prospects among some commodity-exporting emerging market and developing economies. Rapid spread of Delta and the threat of new variants have increased uncertainty about how quickly the pandemic can be overcome. Policy choices have become more difficult, with limited room to maneuver.”

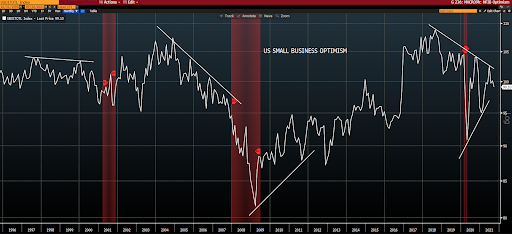

Zeroing on the US; here’s the intro to this morning’s release of the September NFIB Small Business Survey:

“The NFIB Small Business Optimism Index decreased one point in September to 99.1. Three of the 10 Index components improved, five declined, and two were unchanged.

“Small business owners are doing their best to meet the needs of customers, but are unable to hire workers or receive the needed supplies and inventories,” said NFIB Chief Economist Bill Dunkelberg. “The outlook for economic policy is not encouraging to owners, as lawmakers shift to talks about tax increases and additional regulations.”

Key findings include:

- The NFIB Uncertainty Index increased five points to 74.

- Owners expecting better business conditions over the next six months decreased five points to a net negative 33%.

- Fifty-one percent of owners reported job openings that could not be filled, a 48-year record high for the third consecutive month.

- A net 42% of owners reported raising compensation, a 48-year record high.”

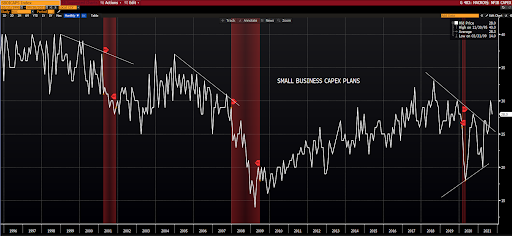

Being that small businesses employ the majority of us Americans, we take this data seriously. It accounts for 3 of our 48 macro index inputs:

Overall optimism:

“I don’t believe that I am an amazing economist who predicts the future. What I actually believe is that I recognize the world as I find it and that I am flexible enough to change my mind.” –Colm O’Shea

Have a great day!