Well, this’ll likely be the last you’ll hear from me for the next week or so. Heading out soon for my annual trek to Montana to do a little fly fishing with a buddy and my dear friend Matt, the fishing guide whom I introduced you to a few years ago. I believe that blog post holds the all-time record for most hits. Linking it to last September’s rendition. Note that this year I’ll be out of the office Monday through Friday.

As for our weekly macro analysis, I’ll keep this one brief.

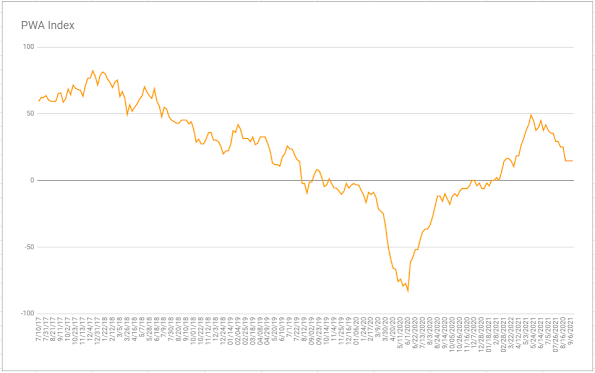

For the 4th consecutive week (that’s unusual) our proprietary index’s overall score remains at 14.58.

While none of our inputs saw score changes this week, there are always a few worth looking at nevertheless.

Such as:

Rail Traffic (rolling over a bit…. speaks as much (if not more) to supply bottlenecks as it does to possibly waning demand):

Citi’s US Economic Surprise Index (data continue to come in below economists’ expectations):

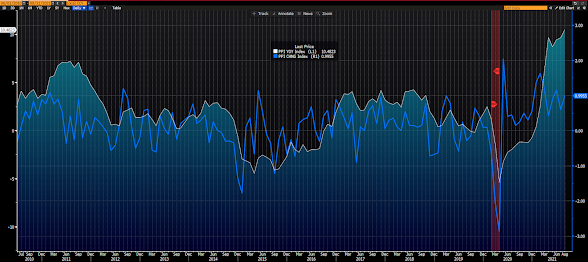

The US Producer Price Index continues to scream inflation!

And commodities (Bloomberg Commodity Index) are threating an upside breakout after 4 months of consolidation:

Other highlights on the week:

Weekly jobless claims came down notably: 310k vs 345k last week. Continuing claims improved just a smidge.

U.S. job openings are virtually off the chart at 10.9 million. Suffice to say that things can’t be all bad when employers are in that much of a hiring mood!

The European Central Bank announced that it will indeed be tapering back its bond purchases in the coming months. That’s interesting to me, as their president is uber-dovish and I honestly expected them to wait for the Fed’s lead. Not that their own inflation prints don’t warrant it…

30-year mortgage rates remained at 3.03%. Week over week purchase app numbers barely budged.

China’s Producer Price Index essentially matched ours; up 9.5% year-on-year. Although their CPI remains curiously subdued.

Japanese economic sentiment is waning, with Delta catching the blame.

German sentiment has weakened as well, with supply bottlenecks reportedly the culprit.

Thanks for reading!

Marty