Despite the present tumults of Afghanistan, Ida and Delta, markets are relatively quiet to start the week.

Only one fed head is scheduled to speak this week (more will miraculously emerge should market volatility heat up), but there’s certainly enough data-wise to get markets’ attention as the week unfolds. The climax being the August jobs numbers due Friday.

Fed Chair Jerome Powell went to great lengths last week to convince the world that present US inflation forces are virtually entirely the cause of supply constraints due to the pandemic.

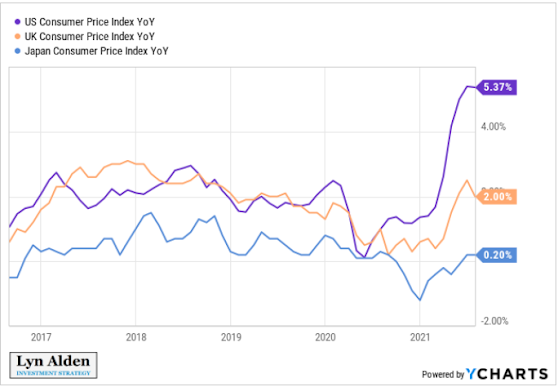

Well, if that were true, given that it’s global, shouldn’t we see pretty much the same inflation prints across nations? Okay, sure, different folks buy/use different stuff, but surely the separation would be narrow, wouldn’t it?

Take a look at macro thinker Lynn Alden’s chart comparing the reads for the U.S., the UK and Japan.

She points out in her excellent 8/29 newsletter:

“Large fiscal stimulus in the United States, monetized by the Federal Reserve, helped boost demand for goods and services in the US but can’t fix supply shortages, and so our nominal GDP bounced back faster than our peers, along with higher price inflation. People can debate about the various trade-offs for how much fiscal support is useful, what format that fiscal support is best used in, etc. But it does come with costs, in addition to its benefits.”

As we’ve pointed out “large fiscal stimulus in the United States, monetized by the Federal Reserve”, given today’s (debt, political, populist, emerging de-global, etc.) setup, is essential to policymaker aims going forward.

I.e., we ultimately see inflation (higher than folks are accustomed to) as a lasting thing…

Asian equities were green overnight, with only 1 of the 16 markets we track closing lower.

Europe, however, is leaning a bit red so far this morning, with 10 of the 19 bourses we follow trading down.

U.S. stocks are mixed: Dow down 73 points (0.20%), SP500 up 0.29%, SP500 Equal Weight down 0.12%, Nasdaq 100 up 0.79%, Nasdaq Comp up 0.64%, Russell 2000 down 0.23%.

The VIX sits at 16.46, up 0.43%.

Oil futures are down 0.39%, gold’s down 0.45%, silver’s down 0.49%, copper futures are up 1.14% and the ag complex is up 0.10%.

The 10-year treasury is up (yield down) and the dollar is up 0.03%.

Led by ALB (lithium miner), solar stocks, uranium miners, wind stocks and AMD — but dragged by Viacom, energy stocks, banks, gold miners and base metals miners — our core portfolio is off 0.06% to start the day.

“We should never become so enamored with the strong points in our thinking that we overlook the weakest links in the chain.” –Gary Orren

Have a great day!