15 of the 24 July global manufacturing purchasing manager’s indices that were posted overnight showed declining sentiment readings (vs June’s). With presently covid-stricken areas of Asia of course faring the worst.

Overall, however, the underlying tone, on balance, remains expansionary.

What also remains are some serious inflationary pressures.

Here’s from major global player South Korea’s release:

“Latest data pointed to a further rapid rise in input prices…This extended the current sequence of inflation to 13 months, with costs rising at the 2nd fastest pace in the survey’s history. Businesses widely reported sharp rises in the cost of raw materials amid shortages. Concurrently, output prices increased at a survey record pace for the 3rd time in as many months as firms sought to pass higher costs on to clients.”

Here’s from the Eurozone’s:

“the July survey brought further signs that manufacturers and their suppliers are struggling to raise production fast enough to meet demand, driving prices even higher.”

“…price pressures meanwhile show no sign of abating, with July seeing another record increase in both input costs and prices charged for goods as demand exceeds supply, and concerns over future supply availability flare up again.”

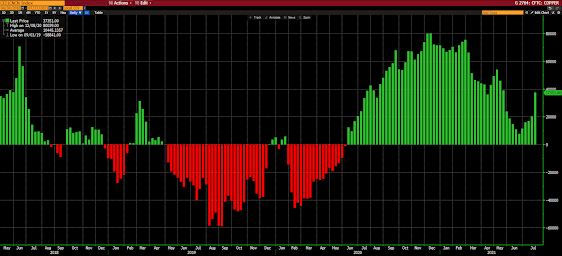

We remain longer-term bullish most things resource. Looks like speculators in copper futures (net positioning below) are — after a notable price correction off the mid-may peak — feeling it again:

Uncommon commonsense from Ray Dalio:

“When everybody thinks the same thing—such as what a sure bet the Nifty 50 is—it is almost certainly reflected in the price, and betting on it is probably going to be a mistake.”