One of the late great economist Milton Friedman’s oft-quoted assertions is:

Suggesting that if the powers that “print” money print more over a given period than the economy’s wherewithal to absorb it, inflation is your unavoidable consequence.

Well, if that’s true, how is it that we’ve seen a pretty steady drip, at times garden hose, of money printing the past 25 years with very little inflation to show for it?

White line = Fed Balance Sheet (call it money printing), yellow = CPI:

“If you and five others are stranded on a desert island and you have a granola bar for sale, what’s it worth? If your famished fellow castaways have one dollar among them, it’s worth a dollar. If they have ten, it’s worth ten.”

“But what if the castaways have ten dollars and you happen to have two granola bars? Well then, they’re worth five each. Then, if a chimp steals and eats one, the remaining one, experiencing 100 percent inflation, is worth ten. Now wouldn’t that be a supply disruption, as opposed to a monetary phenomenon? Yes, that would be a supply disruption, and a monetary phenomenon. In that the supply of money did indeed increase—on a per-unit basis.”

And, lo and behold, today we get both; supply disruptions and, per the right corner of the above chart, an increase (an epic one no less) in the supply of money (assuming that newly “printed” money escapes the bank reserves channel [much of it is/will this time around])!

As I’ve been stating herein of late, despite having lived intimately with all things market and economic since 1984 — while I remain open to all possibilities — I’m in the camp that believes we’re finally staring down decent odds that inflation post the current supply shock will be structurally rising phenomena.

While we dabbled in commodities off and on, although always sparingly, the past few years, we viewed the modest periodic bouts of inflation between 1999 (the last time we held gold as a core position) and the present as most-likely transitory, which is precisely what they turned out to be.

Including gold (which one might argue is more a currency than a commodity), commodities currently occupy roughly 23% of our core portfolio. Throw in our exposure to materials, mining and energy stocks, and we’re expressing our forward inflation (and infrastructure spending) view to the tune of roughly 38% of our core asset mix.

So why now, after all these years, do I see inflation as a potentially long-term risk going forward? In other words, what’s different this time?

Well, for starters, as it turns out Dr. Friedman may not have been all that remiss in leaving velocity out of the equation after all.

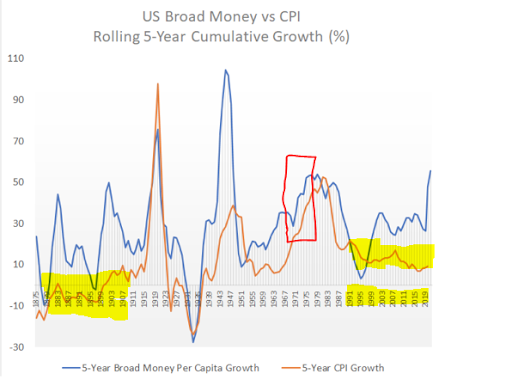

Compliments of macro strategist Lynn Alden, here’s a 70-year chart of just U.S. money supply (blue) vs inflation (orange), on a 5-year rolling basis:

- Technological advances of a rising superpower

- Abundant land (capacity)

- Cheap immigrant labor

- Huge supply of oil meeting innovation in refining and transportation

As for the 1990s, of course that one’s easy; an epic tech revolution unfolded, creating disinflationary productivity gains (blue line below) like nothing seen since, well, the late-1800s:

- Expanding free trade

- Cheap labor from Mexico, China, Eastern Europe, etc.

- Increasing populism (a serious headwind for global trade — in both goods and in labor).

- A continual stimulating of the economy via monetary, as well as fiscal policy (facilitated by easy monetary policy) — demanded by a politically-powerful populist movement.

- China maturing into a service-oriented, consumer-driven economy (moving away from providing cheap labor and goods to the outside world, and, thus, no longer needing to actively devalue the yuan (in many respects the opposite).

- The Fed’s fear of bursting present asset and debt bubbles were it to implement traditional inflation-fighting measures — thus willing to fall notably behind the inflation curve well into the foreseeable future. In fact, I personally place better than 50/50 odds that if indeed a long-term trend of rising inflation emerges, that the Fed will revert to yield curve control (buying up the price (down the yield) of longer-term treasuries) to control lending rates that, were they allowed to rise, would themselves produce a headwind to rising inflation.

- The trillions of dollar-denominated debt sitting on foreign corporate balance sheets inspiring an active campaign by the Fed to keep the dollar at bay, in an effort to avert what could otherwise turn into a very messy global currency crisis.