The mere mention by a Fed governor of what Fed Chair Powell refused to mention during Wednesday’s press conference has sent stocks into a minor tizzy this morning, the dollar into serious rally mode, and yet, and fascinatingly, hardly anything in the bond market.

“FED’S KAPLAN: THE FED SHOULD START TALKING ABOUT TAPERING BOND-BUYING SOON.”

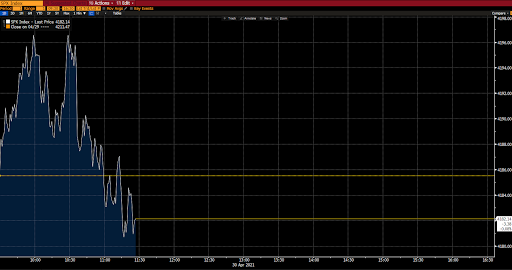

Again, stocks are taking the mention seriously (although, let’s not freak out over a <1% hit):

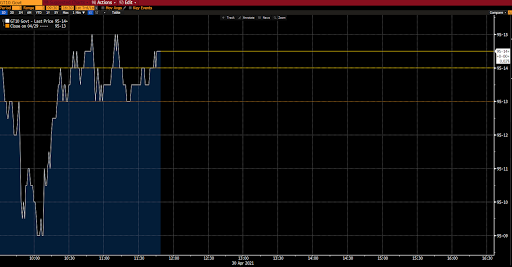

Treasuries, however, as I suggested above, are essentially saying “nah, it’s just noise.” I.e., any tightening of policy (tapering purchases or raising rates) would send treasury yields — at this juncture — through the proverbial roof. Until, or unless, that is, the markets believed that such tightening would actually halt the recovery in its tracks:

For today this is all about fear of less juice for asset markets, as opposed to fear over the status of the recovery…