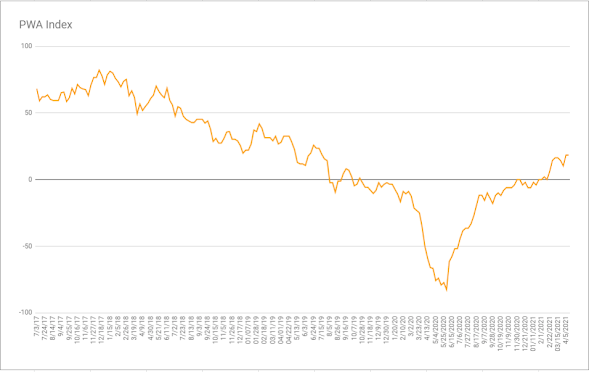

While our macro index’s overall score didn’t budge this week (remaining at +18.37), the number of positive inputs did rise to 45% of the total, negatives also rose, to 27%, neutral inputs declined to 28%.

Only two realized individual score changes, 1 up, 1 down. Ironically, they both emerged from the jobs data:

Initial Jobless Claims (the one negative score-changer) rose for the second straight week:

While there’s much optimism over the economy going forward, the number of folks filing those initial claims nevertheless remains historically high, per the red horizontal line on the 60-year chart below:

The positive (unambiguously so) employment-related number reported this week was total job openings:

Yep, I know what you’re thinking, a huge number of folks are filing unemployment claims, while the number of jobs available just rose to a near-record high. So what gives?

Well, clearly, extremely generous unemployment benefits are a (if not “the”) major factor — but there also remains a not-small overall mismatch in terms of job availability, the labor pool, and the education/qualifications necessary to fill many of those spots…

Other inputs worth a look:

Redbook’s weekly retail sales:

Now, this is where things get a bit kooky going forward. That huge spike in retail sales is a weekly move, but it’s on a year-over-year basis. Meaning, the % move vs this week last year — which was when we were in the very depths of the worst recession since the Great Depression. We’ll be factoring this into our assessment in the weeks/months to come…

Weekly Mortgage Purchase Apps:

While the residential market remains hot, consequently low inventory and rising interest rates seem to be cooling mortgage demand a bit.

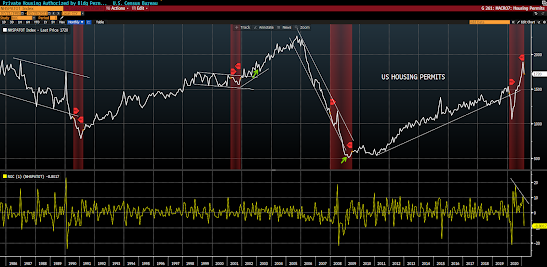

And, again (we touched on these when they were released last month), other housing data have exhibited some softening of late as well:

Permits:

Starts:

A rising Global Composite Purchasing Managers Index speaks to the optimism we’ve been referencing in the surveys:

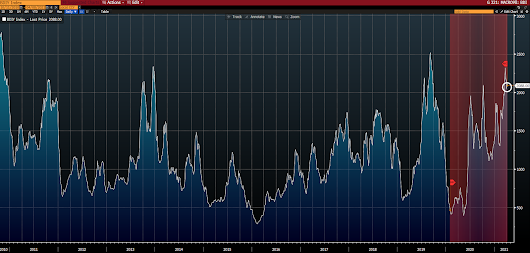

Bloomberg Commodity Index:

As you know, we’re presently long-term bullish on commodities. Technically-speaking, that’s quite the bull flag pattern (in yellow) developing.

The Baltic Dry Index:

While typically we’d view rising shipping costs as a bullish sign with regard to global activity, it presently reflects a lack of capacity (available containers, etc.) in a big way, as well…

One tidbit from the European front; German Factor Orders were on the rise last month. Of particular interest to us (as we hold, and are looking to scale further into, lithium, rare earth minerals, and other [related] metals miners), was the big 20% month-on-month jump in EV battery orders:

One tidbit from the European front; German Factor Orders were on the rise last month. Of particular interest to us (as we hold, and are looking to scale further into, lithium, rare earth minerals, and other [related] metals miners), was the big 20% month-on-month jump in EV battery orders:

Graph courtesy of Bespoke Investment Group.

Yes, folks, we’re there… EV’s will dominate auto sales in the years to come!

On stocks:

The Bank for International Settlements is out with its March quarterly review of international banking and financial market developments. And while its economists share our concerns over very stretched U.S. equity market valuations, they, like so many macro analysts these days, do seem to find comfort in the popular mantra that historically-low interest rates justify such lofty metrics.

My problem with the stocks are historically pricey, but it’s okay because interest rates are historically low, narrative is the lack of serious acknowledgement of what historically low interest rates say about the state of the overall economy — and how historically high stock prices fly directly in the face of that signal.

Now, there’s of course the artificiality (read Fed manipulation) of yields one can point to that suggests things are much better than these crazy-low interest rates otherwise signal (which indeed is the message from the improving data). But then one must ask, why, if things are really better than rates suggest, would the Fed need to keep them artificially low?

Well, that speaks to the utterly-monstrous debt bubble lurking below the surface that higher rates would ultimately pierce. As well as the fact that present equity market valuations only work at these artificially-suppressed rates.

I.e., asset bubbles abound, and it may just take the bursting of one to set off a potentially devastating chain reaction.

I know, I sound like such a bear!

Thing is, I can’t make this stuff up. But, you know, bubbles can last a very long time. And it’s, therefore, a fools errand to try to predict when, or even if, they’re going to burst.

That said, it’s the utter definition of foolish to do the work, see the risk, and not accommodate for it — through diversification into, for example, areas like precious metals, other commodities (including those receiving huge government support) and global equities, while, not to mention, outright hedging with options under such conditions.

Speaking of diversifying into global equities, presently 1/2 of our equity exposure is targeted to companies domiciled outside the U.S..

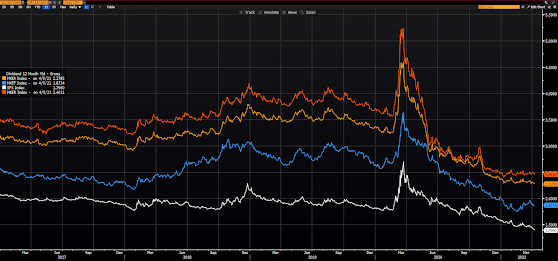

Here’s partly why:

Take a look at U.S. equities (white) vs developed foreign equities (yellow), emerging foreign equities (blue) and specifically, among developed foreign, Europe equities (orange) on a price to sales basis:

On a 10-year relative return basis:

And on a dividend yield basis:

Clearly, relative opportunities (read cheaper valuations, reversion to the mean [performance catchup] potential, and notably higher dividend yields) presently abound outside our borders…

And, lastly, with regard to the opportunities in the commodities’ space, aside from the obvious, consider the relative performance setup that’s developed over the past 10 years.

I.e., while U.S. major equity averages are stretching epically into all time high territory, commodities and miners are just now breaking out of a decade-long downtrend:

Hmm…

Have a great weekend!

Marty