Pretty much the same junky look for equities this morning that characterized yesterday’ session: ~60% of the SP500’s members are in the red, Nasdaq comp’s losers are besting gainers 2 to 1, and so on.

The dollar and interest rates are both up, which is playing havoc with everything from tech stocks to commodities… Remember, both rates and the dollar, on a sustainably rising basis, are anathema to what the Fed aims to accomplish as we meander through what is a most, well…. we’ll call it dynamic, macro/market setup.

Biden’s set to talk up infrastructure spending like we’ve never seen tomorrow afternoon. If he’s convincing, it could play nicely for our materials, metals, etc., exposures…

But, thing is, if he’s convincing, we could see rates even higher in response.

Man, this has to be playing on the nerves of all those folks who thought growth stocks would continue to rocket to the moon!

Well, they certainly might resume their march into the stratosphere (especially if/when the Fed steps onto the long end of the treasury yield curve), but this isn’t the best technical setup I’ve ever seen:

QQQ (Nasdaq 100 tracking ETF):

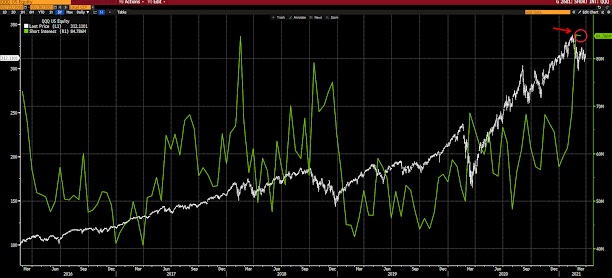

The shorts (green line) are certainly piling on to QQQ:

“When will come the next great speculative episode, and in what venue will it recur—real estate, securities markets, art, antique automobiles?

To these there are no answers; no one knows, and anyone who presumes to answer does not know he doesn’t know.

But one thing is certain: there will be another of these episodes and yet more beyond.

Fools, as it has long been said, are indeed separated, soon or eventually, from their money.

So, alas, are those who, responding to a general mood of optimism, are captured by a sense of their own financial acumen. Thus it has been for centuries; thus in the long future it will also be.”