Asia once again leaned green overnight, with 9 of the 16 markets we track closing higher.

Europe, riding rising sentiment and vaccine prospects, while ignoring rising risk of a no-trade-deal Brexit come 12/31 (I’ll be surprised if there’s ultimately no deal), is mostly higher — 13 of the 19 bourses we follow are in the green — so far this morning.

US major averages, save for the Nasdaq Comp, continue to — albeit slowly this morning — climb a wall of extreme (dangerously extreme) optimism: Dow up 57 points (0.19%), S&P 500 up 0.11%, Nasdaq down 0.08%, Russell 2000 up 0.53%.

The VIX (SP500 implied volatility) is down 0.89%. VXN (Nasdaq i.v.) is down 0.99%.

Oil futures are down 0.13%, gold’s up 0.26%, silver’s up 0.04%, copper futures are down 0.67% and the ag complex is down 0.72%.

The 10-year treasury is up (yield down) and the dollar is up 0.10%.

Led by energy, AT&T, materials, staples and healthcare, our core portfolio is up 0.16% to start the session. Base metals, agriculture, Verizon, utilities and banks are our main laggards.

While I continue to write, and to illustrate, ad nauseam, about what is a debt bubble for the ages, Wall Street’s bullish counter to that bearish reality is the fact that corporations and consumers are currently sitting on a mountain of cash.

It’s absolutely true, and it absolutely has our attention!

The bullish narrative is essentially “Just wait. Once we get the vaccine and life gets back to normal there’s massive pent up demand, and the cash to make good on it, that’ll be unleashed onto the economy the likes of which we seldom see!”

While we’re open to that narrative, and fully intend to exploit it should it be true, I’m, frankly, not all on board just yet.

I’ll dig deeper into why in upcoming epistles, but, for today, suffice to say that the present macro backdrop — the end of a multi-decade debt cycle — is reminiscent of periods past (1930s U.S., 80s/90s Japan) and, thus, demand that we study those events (we have and are) and understand the actions of policymakers and private sector actors, their consequences, lessons learned, etc., at those times to help us at least gauge probabilities going forward.

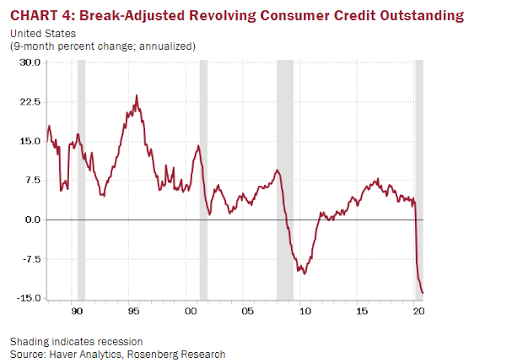

The fact that consumers have been paying down revolving debt, while presently saving at a 13.5% of income pace — while nothing at this point long-term conclusive — is reminiscent of the Japan experience; where the private sector became ultimately interested in repairing its balance sheet — which had long-term effects on both economic activity as well as policy:

Have a great day!

Marty