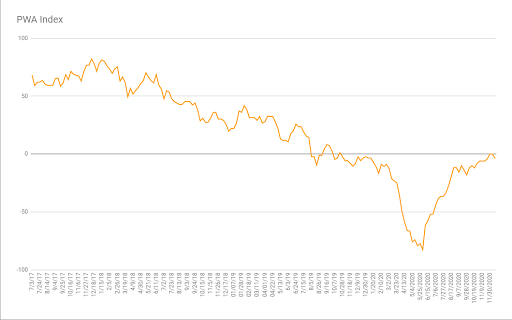

As our macro index has been climbing its way out of virtually unfathomable depths of late, I suspect you’ve noticed an air of skepticism in my commentaries.

That largely stems from my awareness of the sheer enormity of support the powers-that-be have brought to bear in their efforts to avoid what seemed destined to be a deep, protracted recession and historic bear market in asset prices.

It also stems from my study of major financial crises past and the fact that without exception they were the culminations of years of unrelenting buildups of private sector debt.

Therefore, graphs like the lower right from the Bank of International Settlements’ (the central banks’ central bank) latest quarterly review trouble me: I red-dotted the U.S. debt service ratio in ’08 and current…

And, not to mention, this one (blue line) from the St. Louis Federal Reserve, which you’ve seen herein before: grey areas denote recessions…

As for the “support brought to bear”, well, the federal government has literally increased its debt by an incredible $5.2 trillion dollars, annualized, so far this year.

Now, if you’re thinking all was dandy pre-covid, well, think again; in 2019 the Federal government ran just shy of a $1 trillion budget deficit.

Folks, that’s called debt-fueled growth, which, again, is not the stuff of sustainable prosperity-producing economies…

While the improving data has, well, improved, I’ve been hinting and charting that some of the still-negative-scoring data has been rolling over of late.

Therefore, I wasn’t the least bit surprised to see our index dip back into the red this week, albeit slightly.

After two weeks on the flatline its overall score dipped to -4.08:

Four inputs gave up a point…

Mortgage Purchase Apps:

Small Business Optimism:

Small Business Capex Plans:

Heavy Truck Sales:

While two gained a point:

Small Business Hiring Plans, ironically (given the above):

Bloomberg Commodity Index:

Being that small businesses — the employers of 2/3rds of our workforce — are the backbone of the U.S. economy, let’s dig a little deeper into the latest NFIB survey,

For starters, it’s puzzling that overall optimism seems to be waning when we consider the euphoria discounted in recent equity market action around the prospects for vaccines and for fiscal stimulus being lavished onto the economy in the coming months.

Here’s a look at the index’s 10 components:

While it’s not all bad — I like the improving employment picture — the fact that the biggest decline came in the “expect economy to improve” category is a bit bewildering, given Wall Street’s giddiness over next year.

Perhaps small business owners are seeing something Wall Street isn’t? Or perhaps it’s that they’ve been among the ones who’ve truly suffered this year (Wall Street certainly hasn’t) and are therefore responsibly guarded in their view of what’s to come. Or perhaps they simply refuse to blindly buy into the notion that, just like that — given what it’s taken in terms of borrowing and spending to ostensibly right the ship — things are going to soon get back to normal… Hmm….

My best guess going into next year is that, indeed, Wall Street’s onto something in terms of the return of animal spirits. Although, per some of the latest data, not to the extent it expects.

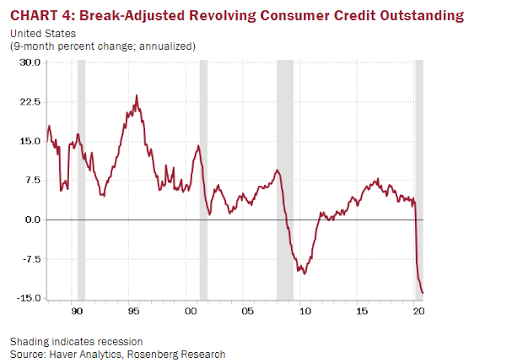

Here’s from my Tuesday note titled Consumer Caution:

The fact that consumers have been paying down revolving debt, while presently saving at a 13.5% of income pace — while nothing at this point long-term conclusive — is reminiscent of the Japan experience; where the private sector became ultimately interested in repairing its balance sheet — which had long-term effects on both economic activity as well as policy:

And here’s our up-to-date charting of the 3 most-followed consumer sentiment surveys:

Clearly the consumer at large is not yet anticipating that pre-covid feel come 2021…

So, THE question being, if/when the consumer truly engages with the fruits of his/her own labor, will the Fed (not to mention the federal government) to any degree be willing to disengage?