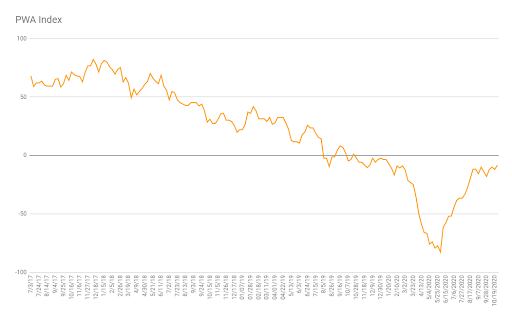

This week saw a notable improvement in our proprietary macro index; up 4 points to a net overall score of -8.16.

“Signs of underlying price pressures building were evident via the largest rise in input costs since February. Increases were reported in both manufacturing and services.”

“Goods producers noted the increased use of discounting to attract clients during October, with selling prices rising only moderately. In contrast, cost burdens rose the steepest rate since January 2019 amid supplier shortages.”

So, “cost burdens” rising at a steep rate for producers, while having to cut prices to attract clients. Well, not the setup we’re looking for!

In closing, and to cut to the chase, while indeed the present setup is anything but ideal, it’s the hand we’re dealt. The secret to long-term investment success (read risk management) is to accurately read that hand. Call it clarity.

Like we said in this week’s main message:

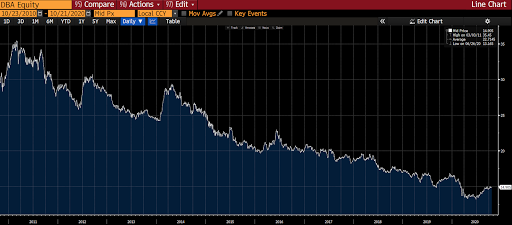

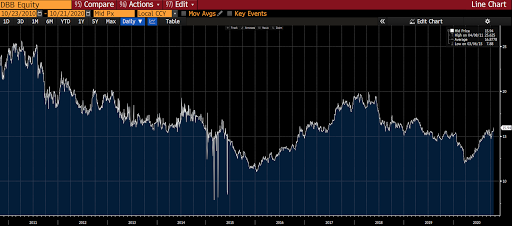

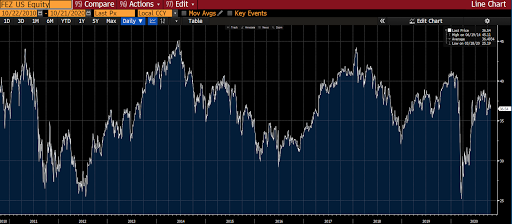

As for markets, ironically, a weak dollar, low interest rate, high government spending environment, by itself is bullish for equity markets. And I firmly believe we’ll discover opportunities therein to exploit going forward. However, without a true market-clearing bear market bringing valuations down to fundamental reality, prudence will demand that we employ smart hedging strategies well into the foreseeable future.That’s a setup that’s also bullish for commodities; many of which that are not coming off of longest-ever bull markets (like U.S. stocks). Quite the opposite in fact.Here’s the 10-year chart of our ag commodities ETF:Base metals:Silver:Gold (although more a currency than a commodity):Versus U.S. stocks…New York Stock Exchange Composite Index:S&P 500 Index:Nasdaq 100 Index:Versus Foreign Stocks:Europe, Australasia and Far East Index ETF:Eurozone:Asia-Pacific:Emerging Markets:A weakening dollar environment (an absolute must for the powers-that-be going forward) favors foreign equities, emerging markets in particular.White line = the US Dollar Index/Orange = our emerging markets index ETF:

Have a nice weekend!

Marty